01 March 2013

From VOCM website:- "The Globe and Mail is reporting that mining giant Rio Tinto has started the process of selling its majority stake in the Iron Ore Company of Canada, the country's largest mining company."

So, while Nalcor/government is speculatively spending billions of the people's money in part to meet the so-called power needs of the mining giants in Labrador, Rio Tinto is selling off.

UNBELIEVABLE

27 February 2013

Excerpt from National Post article :--- "Canada's former spy watchdog, ex-SNC:Lavalin CEO now wanted men in Quebec as fraud probe widens" [http://news.nationalpost.com/2013/02/27/canadas-former-spy-watchdog-arthur-porter-now-a-wanted-man-in-quebec-as-fraud-probe-widens/] "The arrest warrant alleges that Dr. Porter, 56, and Mr. Elbaz, 44, accepted a payment or benefit from former SNC-Lavalin executives Pierre Duhaime and Riadh Ben Aissa sometime between Oct. 16, 2008 and Aug. 31, 2011.

Mr. Duhaime, 58, who was chief executive of SNC-Lavalin at the time of the alleged infractions, and Mr. Ben Aissa, 54, who led the company’s construction business worldwide, were charged last November with fraud and using forged documents in connection with the hospital contract."

[I wonder who was the SNC-Lavalin CEO when SNC-Lavalin was contracted to virtually 'control' the multi-billion dollar Muskrat Falls project?.

Do I, as a voter, a ratepayer, a taxpayer, a citizen of Newfoundland and Labrador [in this open and transparent (sic) democracy] have a right to access that information? ------- IF NOT, WHY NOT? ]

25 February 2013

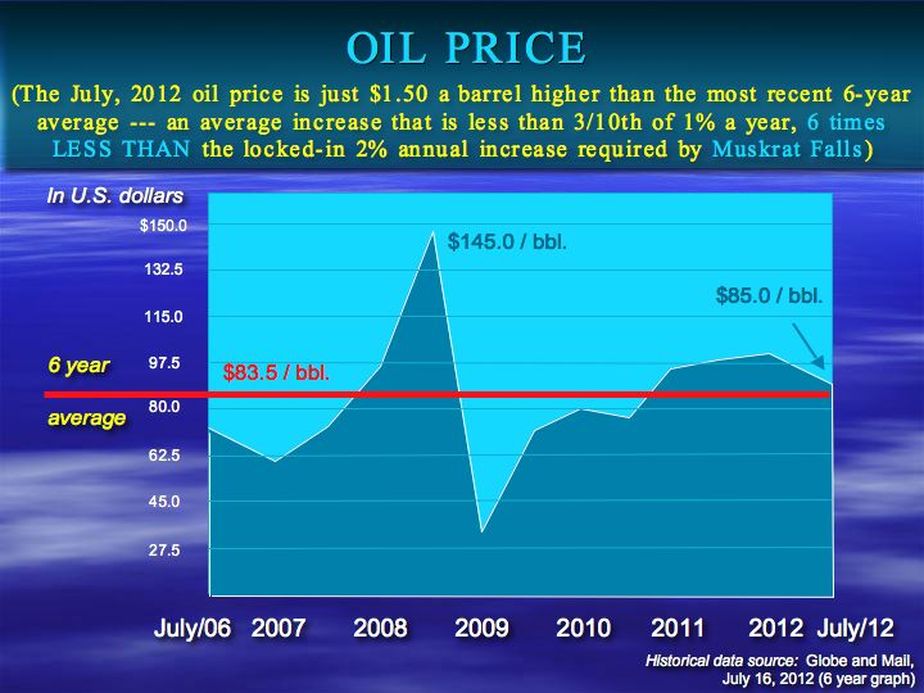

Quote from the Globe and Mail, 25 February 2013 "True innovation doesn't flow from a pipeline" :----- "Last week, PricewaterhouseCoopers predicted that the coming boom in global shale oil production could slash the price of crude by $50 (U.S.) a barrel over the next two decades"

Go to the PriceWaterhouseCoopers --- "Shale oil changes energy markets" (link below) and also see summary excerpt below:

"Shale oil: the next energy revolution Download

22 February 2013

"SNC-Lavalin in Bangladesh, world bank sees conspiracy" (Globe and Mail)

http://www.theglobeandmail.com/report-on-business/snc-lavalin-in-bangladesh-world-bank-sees-conspiracy/article8963225/

21 February 2013

"SNC bribery probe widens to Algeria" (Globe and Mail)

http://www.theglobeandmail.com/report-on-business/snc-bribery-probe-widens-to-algeria/article8907906/

15 February 2013

Oil prices could drop by 40% :---- http://arabnews.com/shale-oil-could-slash-crude-price-40

Also, see this excerpt from today's Sir Robert Bond Papers :-----

"The finance minister forecast a $1.6 billion deficit for a budget he will deliver in a couple of months. This is not an amount you can easily hack out of any budget. To help understand how much money this is, look at Budget 2012. In order to cut $1.6 billion from the budget you would have to wipe out the education department completely, plus take out natural resources, agriculture, trade, industry and tourism and then find another couple of hundred million besides."

http://bondpapers.blogspot.ca/2013/02/if-next-two-years-are-bad-nlpoli.html

11 February 2013

"Former SNC-Lavalin chief charged with fraud" (closer to home)

http://www.theglobeandmail.com/report-on-business/former-snc-lavalin-chief-duhaime-formally-charged-with-fraud/article8448126/

09 February 2013

Canadian National has put the brakes on its estimated $5 BILLION northern Quebec railway line saying "There's a pause because we're evaluating certain timetables and it also has something to do with some projects of mining companies that they seem to have put a hold on at the moment"

http://www.theglobeandmail.com/globe-investor/cn-puts-on-hold-northern-quebec-railway-project/article8401752/

So much for the 10's of billions in Quebec/Labrador mining developments and urgent need for Muskrat Falls power.

07 February 2013

Radio interview with Nova Scotia's Todd McDonald re the Maritime Link http://www.cbc.ca/mainstreetns/

http://www.cbc.ca/mainstreetns/

06 February 2013

Brad Cabana's "Case Against Nalcor" http://rocksolidpolitics.blogspot.ca/

26 January 2013

COMMENT BY Winston Adams- January 26, 2013 at 12:20:04 TIED TO MY "Playing with power numbers" letter published in The Telegram (see LINK, BELOW) :--- I listened to a caller on Vocm who was previously on the board of Nfld Hydro. He said that the transmission lines coming to the Avalon from central cannot handle the load on this end. We have 2-230 kv lines doing that . A line is designed for a certain capacity, and as it gets loaded up a larger percentage of the power gets lost ( in a sense heating the atmosphere). For example, if transmitting 1000 MW, a transmission loss of 7 percent is 70 MW lost ( just avout enough to supply Vale Inco at Long Hr) or thousands of houses in St John's. A third line would give more transmission capacity and also reduce line losses. The caller to Vocm said the third line plan was scuttled. It seems they gambled on MF and to use Holyrood as backup, despite the oil consumption. St. John's is at the extreme end of our power grid, and is vulernable to transmission line reliability and line losses. Line losses is an important reason Holyrood is where it is, near the main load, and a shorter distance and therefore less risk to icing damage to transmission lines. And these factors are a disadvantage for MF, all in the weighing of risks. MF has many more risk including salt in the Alpine region, GIC (geomagnetic induced currents) and other risks. So our on island hydro is the main reliable source of power, and the more of it that gets to the St Johns region the better. The question you pose should be answered by Nalcor. How much island hydro is stranded by insuffiicient transmission capacity to St Johns? Is a third line cost effective? How much oil cost would it have saved the past 5 years and the next 5? Even with MF, with a MF failure, can we get sufficient island hydro to St Johns? These are reasonable questions the media should put to Nalcor or Hydro. They won't respond to questions posed by citizens or ratepayers. So the media must pose questions that are deserving of answers. In the end, power reliability affects everyone. John Smith's statement that we are using every scrap of power we can to meet demand seems intended to confuse the isssue and not answer the question. Certainly we cannot exceed the safe capacity of the lines, but should we have had another line? The issue is not conspiracy theory, but proper planning and risk avoidance. Not a laughing matter John. When is potential power shortages a laughing matter? Hydro officials warned of this, People didn't laugh, but were very concerned. And John blames the age of the Holyrood assets! Remember too , that the plan is to use those same generators at Holyrood even when MF comes on stream. The generators will not stop, they will be used as for voltage support, but without the oil burning. Perhaps John could explain his view that this equipment is obselete and Nalcor plan to use if for voltage support?

Also, see the National Post article regarding alleged SNC-Lavalin bribes:--

http://news.nationalpost.com/2013/01/25/an-amicable-and-mutually-beneficial-relationship-snc-lavalin-bribed-their-way-into-plump-gaddafi-era-contracts-documents-allege/

25 January 2012

$160 million in kickbacks

http://news.nationalpost.com/2013/01/25/millions-in-snc-lavalin-bribes-bought-gaddafi-son-luxury-yachts-unsealed-rcmp-documents-allege/

---------------------------------

Also, the island's Peak Demand (MW) for the last 10 years : ------ 2003 (1,595)--- 2004 (1,598)--- 2005 (1,595)--- 2006 (1,517)--- 2007 (1,540)--- 2008 (1,520)--- 2009 (1,601)--- 2010 (1,478) --- 2011 (1,544) ---- 2012 (1,550) ------- 4 MW BELOW our 10-year average, 21 MW BELOW Nalcor's forecast for year 2012, and the island's already existing installed NET capacity is 1,958 MW.

"Playing with power numbers", Maurice E. Adams, The Telegram:-- http://www.thetelegram.com/Opinion/Letters-to-the-editor/2013-01-25/article-3163674/Playing-with-power-numbers/1

24 January 2012

Not including Holyrood, the existing installed NET power generation capacity on the island is 1,500 megawatts, while the 2012 PEAK DEMAND was 1,550 megawatts -- a shortfall of only 50 megawatts.

Why then is Nalcor using 2 (and sometimes 3) large oil-fired generators at Holyrood producing more than 300 and up to 466 megawatts of power to cover off a 50 megawatt shortfall? Why is it that our already existing non-Holyrood generation capacity is not being used to its fullest --- before firing up Holyrood?

22 January 2012

The island's 'peak demand' for year 2012 was 1,550 MW (up only 6 MW from last year --- a 0.38% increase over last year, and 21 MW BELOW Nalcor's year 2010 forecast of 1,571 MW for year 2012). Our existing installed NET capacity is 1,958 MW.

Also,

See link to Wangersky's Telegram article for more Muskrat info:-

http://www.thetelegram.com/Opinion/Columns/2013-01-22/article-3161171/Something%26rsquos-missing-here/1#Comments

15 January 2013

Emera CEO comment regarding Muskrat Falls power (Jan. 10, 2013) : ----- " We have not signed anything that would obligate Nova Scotia customers to take this energy "

http://thechronicleherald.ca/business/410655-taylor-emera-s-growing-power-raises-worries-about-future-bills#.UPSJu8GzhWQ.mailto

12 January 2013

"Even the best design have flaws", Russell Wangersky, The Weekend Telegram

http://www.thetelegram.com/Opinion/Columns/2013-01-12/article-3155251/Even-the-best-design-have-flaws/1

COMMENT MADE BY WINSTON ADAMS on the above-noted article:-

Winston Adams- January 12, 2013 at 14:10:37 Russell, you say, as to whether we actually NEED the power from Muskrat Falls, "the question has never been objectively answered outside of Hydro's own forecasts..... which don't have a great history of accuracy". Now JM, an economist, had a lengthy presentation to the PUB, that the forocast was biased and unreliable. He pointed to our aging and no growth population, being not properly considered. Feehan, another economist put reasoned arguments against the need of more power. Maurice Adams, on his Vision 2041 website has presented the charts of Hydro's flawed forecast record, and has correctly stated that new houses use less energy than old ones, despite being larger. Even economist Wade Locke stated the economics of MF is questionable and subject to the island forecast holding up. Sullivan, Martin and others have questioned the forecast. I filed a submission to the PUB dealing specifically with that issue, showing that efficiency opportunities were substancial. The Telegram later published 3 pieces showing my analysis from an engineering and mathematics perspective that the efficiency potential was 4 times the present average production of Holyrood, and was so economic as to hold steady or decrease costs to consumers. What was not objective about that analysis. I could not engage Nalcor, journalists, media, or MHAs to open up the issue. When you refer to objective analysis you likey mean a significant study, of this and other considerations. Certainly, I could get no details of Nalcor's efficiency considerations before the MF project was sanctioned. Was it a flawed debate by not properly analysing the need for power, before proceeding with the question of what the source of power would be? Certainly it was flawed, and I suggest deliberately so by the government and Nalcor, who preferred to go with MF whether we need the power on the island or not, as the rationale kept changing. Is it like flogging a dead horse to discuss this need for power now? I would say it is late but appropriate to discuss it. Nalcor has just awarded a contract exceeding 100 million for excavation. But Nfld Power is pushing ahead seeking 8.0 percent increase on residential energy rates. Look at their application. See their reduction to normal forecast due to future declining population, and aging population. See the negative impact on power use with the price increase requested, and superimpose this on what effect another 30 or 40 percent increase will do to load growth. You can see Nfld Power's analysis supports the objective statements made by JM and others. Then look at the Application from the perspective of energy efficiency savings. Also note their concern about having little access to alternative power sources, other than Hydro. You will see we are on a path that separates us from all oher progressive utilities. Others put 5 to ten times more resources into the efficiency and conservation approach with real significant benefits for consumers. This Application confirms a path, with little efficiency effort, to prop up power demand.The negative consequences of not doing a comprehensive analysis of whether ne need more power will rattle our economy and worry all power consumers for a long time. This is but the first of many post MF sanction price hikes. Lets brace ourselves for that. It may not be too late, but Nalcor is certainly ramping up expenses. I hope it doesn't turn out like Joey's follies. Certainly,as the costs esculates, more and more it will be asked "did we need that power for the island'. Meanwhile , in Nova Scotia, their Efficiency Corporation is flying the banner "Home Heating Revolution. Oppressed by the high cost of heating your home? Citizens of Nova Scotia- affordability and comfort are yours for the taking!" And yet such a revolution is technically possible much more easily here. So, I suggest, lets kick the dead horse. What harm is that. We need to know if horse is really dead. Electrical power is rated in terms of horses. And 45 percent of our present horsepower is wasted. Our horses have much more to give. With due attention, our electrical horses are far from exhausted. Where is the proof? Where was that objective study? That is the Question.

My comment earlier today (also on Wangersky's article):-

Russel Wangersky's article in today's Weekend Telegram is nicely written.......... I do think however, that he has it backwards --- I would suggest that "The decision on Muskrat Falls, for better or worse, was made" FIRST, ------ THEN "government accepted the premise that electrical consumption in this province would rise — and that there was nothing that could be done to slow that rate of increase." --------- A means to justify the end. ........The decision was made in 2010 (or earlier) and then government set about creating the various and continually changing justifications and rationale for its decision. ... Almost like 'reverse engineering', where you already have the end product, and then you work backwards so as to include all the elements needed to create the product while discarding all those that don't.,,,,,,,, Kennedy's approach in the House was similar ---- where, instead of keeping an open mind while grasping and arriving at an understanding of whether or not Muskrat Falls was the best option, he said instead that he approached Muskrat Falls by FIRST convincing himself that it was the best option and then went about selling it to the people (the very opposite of a rational, scientific, objective approach)....... The process has, from the beginning, been designed to push Muskrat Falls through --- whether it was and is in the best interest of the people and the province ---- or not ----- whether we need the power ----- or not, whether we can afford it --- or not. ........ NONE OF THAT MATTERS ---- PERIOD.

08 January 2013

We all know Brazil is a very rainy/tropical place. However, today's Globe and Mail reports that the stock market there is taking a beating and Brazil is rationing electricity because low rainfall has meant not enough water to run their hydroelectric generation plants. With global warming, where will the hydro potential for Muskrat Falls be in a decade or so?

Also, the Federal Court has today ruled that Metis rights and entitlements come under the jurisdiction of the federal government. How will this impact on Muskrat Falls, in that Muskrat Falls is within NunatuKavut's land claims area, and has Nalcor/government satisfied its aboriginal obligations pursuant to Bil 61?

05 January 2013

It seems that there is a good chance that Muskrat Falls power will never be exported to the U.S.----- the so-called Water Management Agreement between Nalcor and its subsidiary, CFL-Co, (with itself) is highly suspect and may be in conflict with the 1969 Quebec contract ----- the advertised 824 MW of power, which has since been reported to be an average of only 570 MW, is suspect ----------- the forecast demand on which the very viability of Muskrat Falls depends (an island demand of 0.8% compounded yearly FOR 50 YEARS) is suspect -------- the argument that we need MORE POWER is suspect (40% of 570MW is only 228MW ---- which is less than half our already existing installed and only partially used NET capacity of Holyrood --- which is 466MW) --- the rates for Muskrat Falls power is highly suspect and will likely be much HIGHER THAN government is saying (ratepayers MUST PAY whatever is needed to pay the Muskrat Falls multi-billion dollar cost/debt)........ the original cost of $6.2 billion is highly suspect and when interest costs during construction and cost overruns are included will likely be $12 billion or more (it is already up around $9 billion)........ I could go on and on, but in short, Muskrat Falls is unneeded, uneconomic, and needs to be halted pending an objective and detailed review.

04 January 2013

I note that the Sir Robert Bond Papers blog is asking for Consumer Advocate (Tom Johnson) to resign his position.

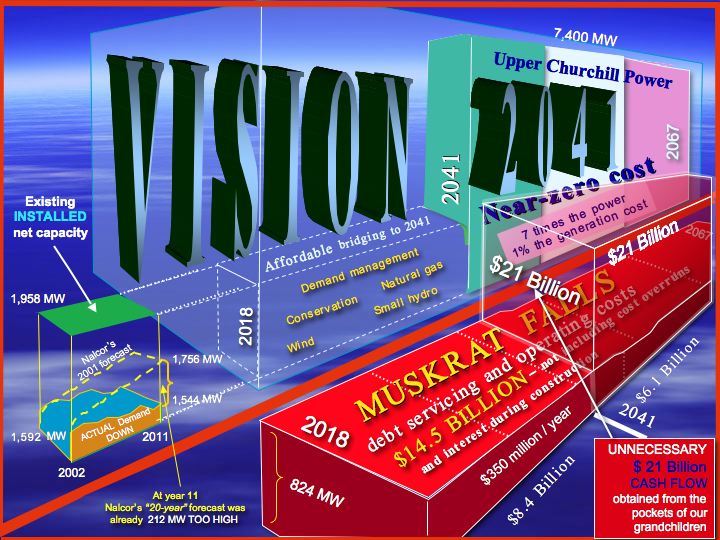

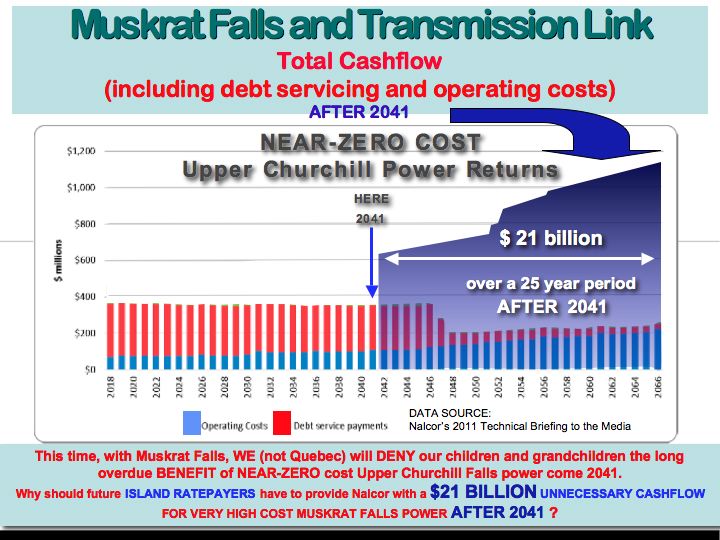

Why isn't Tom Johnson asking why Nalcor/government will be taking $20 billion in revenue/dividends (over and above Muskrat Falls debt servicing and operating costs) out of the pockets of ratepayers over the next 50 years (according Minister Tom Marshall)?

What rate of return is that for Nalor/government?

Why isn't Tom Johnson speaking up for ratepayers, instead of paying lip-service to the job?

Hydro Quebec has more than the equivalent of Muskrat Falls power (and the Romaine will soon be coming on stream) that will be difficult to sell.

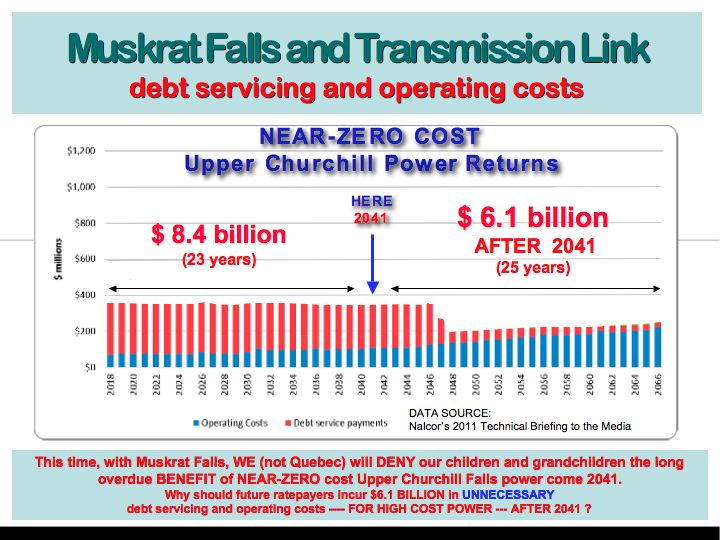

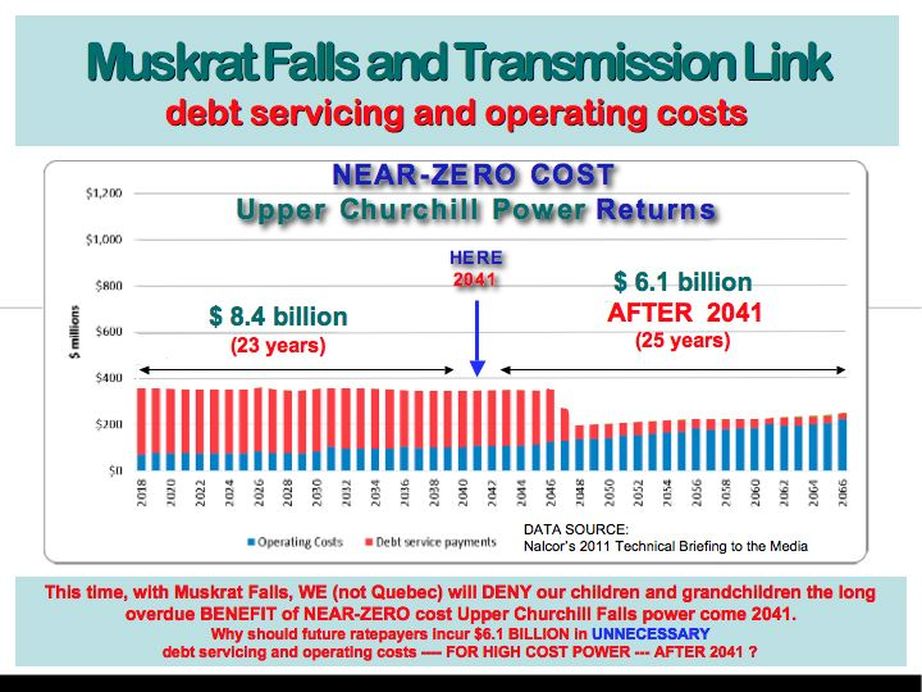

Why isn't Tom Johnson demanding that Nalcor negotiate an early access to Upper Churchill power to meet our needs? Since the market is poor at present for HQ's excess power, don't you think HQ would be willing to provide this province early access to the power we need to get us to 2041? Provided Nalcor would agree to have the equivalent amount of power returned to HQ after 2041 when markets may be better for them?

That would be a win/win situation for both HQ and NL.

NL ratepayers could then save the $29 billion cost (over 50 years) for the Muskrat Falls dam/generation facility (the transmission line cost is only $6 billion over 50 years).

The Muskrat Falls dam/generation facility is a totally unneeded and uneconomic project and should be halted.

26 December 2012

RATEPAYER PROTECTION?

Now that the Public Utilities Board (PUB) is largely out of the picture, how are ratepayers protected?

Is there a need for an independent Ratepayers Association?

The passage of Bill 61 has driven a huge nail in the coffin of ratepayers' rights (and Bill 61 will ensure that there are unnecessarily high electricity bills).

For decades, the Electrical Power Control Act (EPCA) required that the supply, development and distribution of power to consumers would be at "the lowest possible cost consistent with reliable service".

However, Bill 61 has given Cabinet the legislative authority to usurp the rights that ratepayers had previously enjoyed and that were assured by the various provisions of the province's Electrical Power Control Act.

Bill 61 allows Cabinet (at its sole discretion) to direct the Public Utilities Board (PUB) to disregard the EPCA legislated "lowest possible cost" policy requirement (up to now, government has used an "exemption" Order and the "least cost", rather than 'lowest possible cost' slight-of-hand to bypass the 'lowest possible cost' requirement).

Bill 61 now also allows Cabinet (at its sole discretion) to usurp many of the most important rights, authorities, responsibilities and duties of the Public Utilities Board --- thereby effectively neutering the Public Utilities Board, preventing it from protecting the rights (and preventing it from looking out for the best interest) of ratepayers. Now it is ratepayers who must subsidize industrial customers, Nova Scotians and beyond.

Furthermore, the government-appointed Consumer Advocate has been ineffective in preventing these changes (and in fact, supported the Muskrat Falls project and its locked-in, escalating, 50-year, take or pay hidden tax contract).

Accordingly, in order to protect householders/ratepayers, is it now time for an independent "Ratepayers Association", an organization properly structured, ratepayer-funded and managed, and that will stand up for ratepayers' rights --- stand up for their best interests?

A Ratepayers Association could not only lobby government and represent ratepayers at PUB hearings, but a Ratepayers Association would be able to provide information and advice to ratepayers on a range of energy related legislative, regulatory, policy and pricing matters, from "Cost of Service" vs "Power Purchase Agreement" (take or pay) pricing schemes, best practices (engineering, reliability, etc.), other power options, new technologies, energy efficiency, proposed rate increases, demand forecasts, government energy conservation programs, etc., etc.

There are approximately 240,000 households/ratepayers in the province, and a not-for-profit Ratepayers Association (with a board of directors responsible solely to ratepayers), funded perhaps through a small annual fee of $5 to $10, would have considerable influence and would be able to help ensure that ratepayers' rights (and best interests) are represented and protected.

Unchallenged, NL ratepayers will be on the receiving end of a Muskrat Falls, multi-billion dollar TAX GRAB. Ratepayers will subsidize power (for at least 35 years) to mining companies, to the Maritime provinces and potentially to the eastern U.S.

There are better (and lower cost) power supply, development and distribution options, options that are potentially able to provide ratepayers with decreasing, rather than yearly escalating, locked-in prices for 50 years (there are ways that householders/ratepayers can on average pay a thousand, and perhaps even several thousand dollars each and every year LESS THAN the BILLIONS (cumulatively) that Minister Marshall says Muskrat Falls will take out of the pockets of ratepayers over the next 50 years).

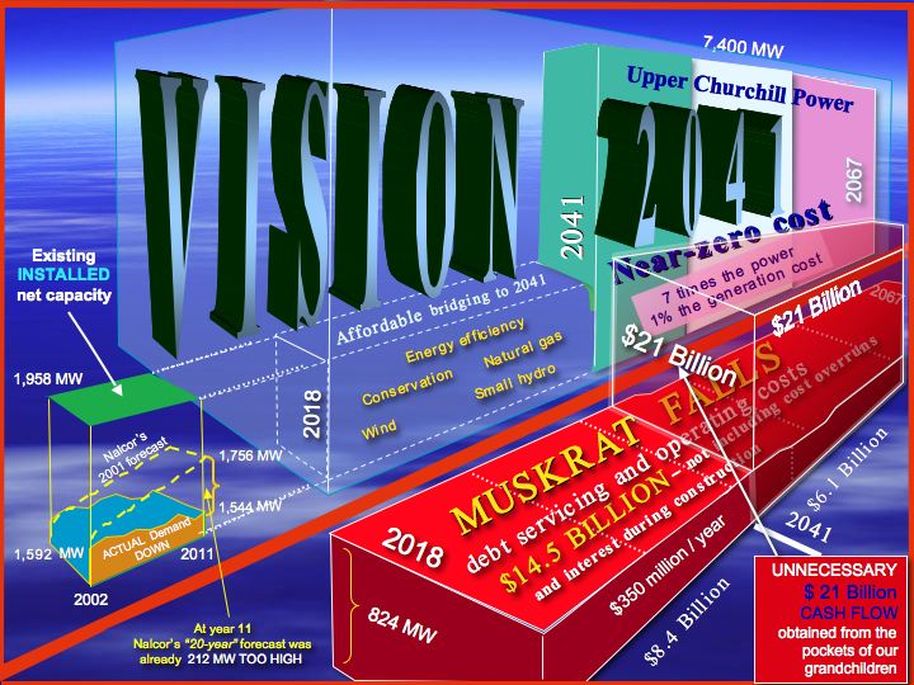

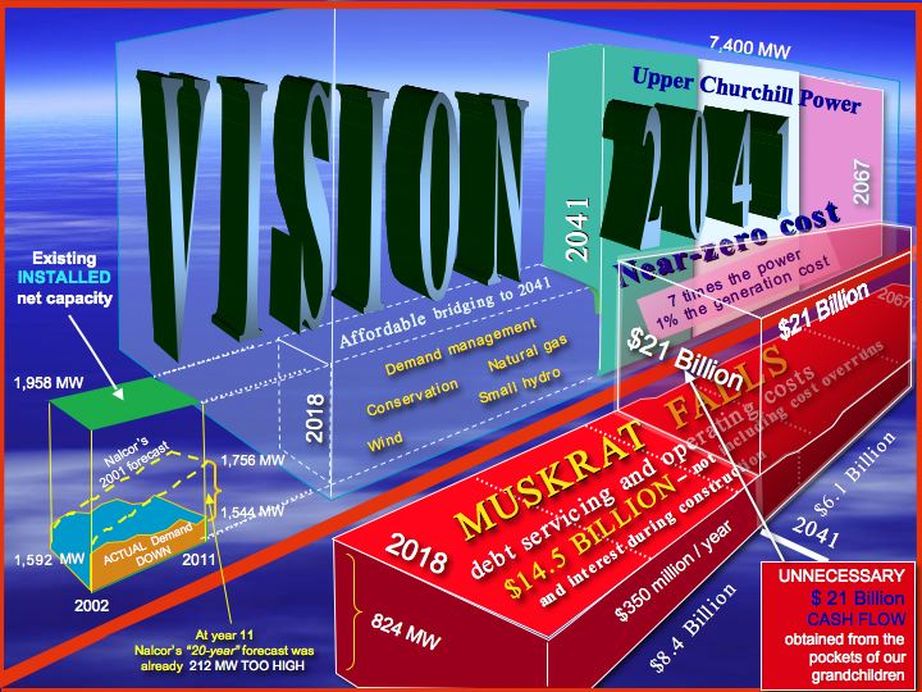

The info-graphic below shows that over the next 50 years Nalcor/Government will extract (UNNECESSARILY) about $35 billion from ratepayers' pockets, their children, and grandchildren --- and Premier Dunderdale is also now hinting at higher taxes (most likely on low and middle income earners) in order to deal with the province's deficit, a large part of which is caused by Muskrat Falls.

So --- is exploring the need for an independent Ratepayers Association a worthwhile endeavour?

Or is there another way to shed light on, and lessen the impact of, Muskrat Madness?

CLICK IMAGE TO ENLARGE

From VOCM website:- "The Globe and Mail is reporting that mining giant Rio Tinto has started the process of selling its majority stake in the Iron Ore Company of Canada, the country's largest mining company."

So, while Nalcor/government is speculatively spending billions of the people's money in part to meet the so-called power needs of the mining giants in Labrador, Rio Tinto is selling off.

UNBELIEVABLE

27 February 2013

Excerpt from National Post article :--- "Canada's former spy watchdog, ex-SNC:Lavalin CEO now wanted men in Quebec as fraud probe widens" [http://news.nationalpost.com/2013/02/27/canadas-former-spy-watchdog-arthur-porter-now-a-wanted-man-in-quebec-as-fraud-probe-widens/] "The arrest warrant alleges that Dr. Porter, 56, and Mr. Elbaz, 44, accepted a payment or benefit from former SNC-Lavalin executives Pierre Duhaime and Riadh Ben Aissa sometime between Oct. 16, 2008 and Aug. 31, 2011.

Mr. Duhaime, 58, who was chief executive of SNC-Lavalin at the time of the alleged infractions, and Mr. Ben Aissa, 54, who led the company’s construction business worldwide, were charged last November with fraud and using forged documents in connection with the hospital contract."

[I wonder who was the SNC-Lavalin CEO when SNC-Lavalin was contracted to virtually 'control' the multi-billion dollar Muskrat Falls project?.

Do I, as a voter, a ratepayer, a taxpayer, a citizen of Newfoundland and Labrador [in this open and transparent (sic) democracy] have a right to access that information? ------- IF NOT, WHY NOT? ]

25 February 2013

Quote from the Globe and Mail, 25 February 2013 "True innovation doesn't flow from a pipeline" :----- "Last week, PricewaterhouseCoopers predicted that the coming boom in global shale oil production could slash the price of crude by $50 (U.S.) a barrel over the next two decades"

Go to the PriceWaterhouseCoopers --- "Shale oil changes energy markets" (link below) and also see summary excerpt below:

"Shale oil: the next energy revolution Download

- The global impact of shale oil could revolutionise the world’s energy markets over the next couple of decades, resulting in significantly lower oil prices, higher global GDP, changing geopolitics and shifting business models for oil and gas companies, according to new analysis from PwC.

- The potential availability and accessibility of significant resources of shale oil around the globe - and the potential effect of increased shale oil production in limiting growth in global oil prices - has implications that stretch far beyond the oil industry.

- Shale oil has the potential to reshape the global economy, increasing energy security, independence and affordability in the long term. However, these benefits need to be squared with broader environmental objectives at both the local and global level.

- The effects of a lower oil price resonate along the entire energy value chain, and investment choices based on long-term predictions of a steady increase in real oil prices may need to be reassessed. The potential magnitude of the impact of shale oil makes it a profound force for change in energy markets and the wider global economy. It is therefore critical for companies and policy-makers to consider the strategic implications of these changes now."

22 February 2013

"SNC-Lavalin in Bangladesh, world bank sees conspiracy" (Globe and Mail)

http://www.theglobeandmail.com/report-on-business/snc-lavalin-in-bangladesh-world-bank-sees-conspiracy/article8963225/

21 February 2013

"SNC bribery probe widens to Algeria" (Globe and Mail)

http://www.theglobeandmail.com/report-on-business/snc-bribery-probe-widens-to-algeria/article8907906/

15 February 2013

Oil prices could drop by 40% :---- http://arabnews.com/shale-oil-could-slash-crude-price-40

Also, see this excerpt from today's Sir Robert Bond Papers :-----

"The finance minister forecast a $1.6 billion deficit for a budget he will deliver in a couple of months. This is not an amount you can easily hack out of any budget. To help understand how much money this is, look at Budget 2012. In order to cut $1.6 billion from the budget you would have to wipe out the education department completely, plus take out natural resources, agriculture, trade, industry and tourism and then find another couple of hundred million besides."

http://bondpapers.blogspot.ca/2013/02/if-next-two-years-are-bad-nlpoli.html

11 February 2013

"Former SNC-Lavalin chief charged with fraud" (closer to home)

http://www.theglobeandmail.com/report-on-business/former-snc-lavalin-chief-duhaime-formally-charged-with-fraud/article8448126/

09 February 2013

Canadian National has put the brakes on its estimated $5 BILLION northern Quebec railway line saying "There's a pause because we're evaluating certain timetables and it also has something to do with some projects of mining companies that they seem to have put a hold on at the moment"

http://www.theglobeandmail.com/globe-investor/cn-puts-on-hold-northern-quebec-railway-project/article8401752/

So much for the 10's of billions in Quebec/Labrador mining developments and urgent need for Muskrat Falls power.

07 February 2013

Radio interview with Nova Scotia's Todd McDonald re the Maritime Link http://www.cbc.ca/mainstreetns/

http://www.cbc.ca/mainstreetns/

06 February 2013

Brad Cabana's "Case Against Nalcor" http://rocksolidpolitics.blogspot.ca/

26 January 2013

COMMENT BY Winston Adams- January 26, 2013 at 12:20:04 TIED TO MY "Playing with power numbers" letter published in The Telegram (see LINK, BELOW) :--- I listened to a caller on Vocm who was previously on the board of Nfld Hydro. He said that the transmission lines coming to the Avalon from central cannot handle the load on this end. We have 2-230 kv lines doing that . A line is designed for a certain capacity, and as it gets loaded up a larger percentage of the power gets lost ( in a sense heating the atmosphere). For example, if transmitting 1000 MW, a transmission loss of 7 percent is 70 MW lost ( just avout enough to supply Vale Inco at Long Hr) or thousands of houses in St John's. A third line would give more transmission capacity and also reduce line losses. The caller to Vocm said the third line plan was scuttled. It seems they gambled on MF and to use Holyrood as backup, despite the oil consumption. St. John's is at the extreme end of our power grid, and is vulernable to transmission line reliability and line losses. Line losses is an important reason Holyrood is where it is, near the main load, and a shorter distance and therefore less risk to icing damage to transmission lines. And these factors are a disadvantage for MF, all in the weighing of risks. MF has many more risk including salt in the Alpine region, GIC (geomagnetic induced currents) and other risks. So our on island hydro is the main reliable source of power, and the more of it that gets to the St Johns region the better. The question you pose should be answered by Nalcor. How much island hydro is stranded by insuffiicient transmission capacity to St Johns? Is a third line cost effective? How much oil cost would it have saved the past 5 years and the next 5? Even with MF, with a MF failure, can we get sufficient island hydro to St Johns? These are reasonable questions the media should put to Nalcor or Hydro. They won't respond to questions posed by citizens or ratepayers. So the media must pose questions that are deserving of answers. In the end, power reliability affects everyone. John Smith's statement that we are using every scrap of power we can to meet demand seems intended to confuse the isssue and not answer the question. Certainly we cannot exceed the safe capacity of the lines, but should we have had another line? The issue is not conspiracy theory, but proper planning and risk avoidance. Not a laughing matter John. When is potential power shortages a laughing matter? Hydro officials warned of this, People didn't laugh, but were very concerned. And John blames the age of the Holyrood assets! Remember too , that the plan is to use those same generators at Holyrood even when MF comes on stream. The generators will not stop, they will be used as for voltage support, but without the oil burning. Perhaps John could explain his view that this equipment is obselete and Nalcor plan to use if for voltage support?

Also, see the National Post article regarding alleged SNC-Lavalin bribes:--

http://news.nationalpost.com/2013/01/25/an-amicable-and-mutually-beneficial-relationship-snc-lavalin-bribed-their-way-into-plump-gaddafi-era-contracts-documents-allege/

25 January 2012

$160 million in kickbacks

http://news.nationalpost.com/2013/01/25/millions-in-snc-lavalin-bribes-bought-gaddafi-son-luxury-yachts-unsealed-rcmp-documents-allege/

---------------------------------

Also, the island's Peak Demand (MW) for the last 10 years : ------ 2003 (1,595)--- 2004 (1,598)--- 2005 (1,595)--- 2006 (1,517)--- 2007 (1,540)--- 2008 (1,520)--- 2009 (1,601)--- 2010 (1,478) --- 2011 (1,544) ---- 2012 (1,550) ------- 4 MW BELOW our 10-year average, 21 MW BELOW Nalcor's forecast for year 2012, and the island's already existing installed NET capacity is 1,958 MW.

"Playing with power numbers", Maurice E. Adams, The Telegram:-- http://www.thetelegram.com/Opinion/Letters-to-the-editor/2013-01-25/article-3163674/Playing-with-power-numbers/1

24 January 2012

Not including Holyrood, the existing installed NET power generation capacity on the island is 1,500 megawatts, while the 2012 PEAK DEMAND was 1,550 megawatts -- a shortfall of only 50 megawatts.

Why then is Nalcor using 2 (and sometimes 3) large oil-fired generators at Holyrood producing more than 300 and up to 466 megawatts of power to cover off a 50 megawatt shortfall? Why is it that our already existing non-Holyrood generation capacity is not being used to its fullest --- before firing up Holyrood?

22 January 2012

The island's 'peak demand' for year 2012 was 1,550 MW (up only 6 MW from last year --- a 0.38% increase over last year, and 21 MW BELOW Nalcor's year 2010 forecast of 1,571 MW for year 2012). Our existing installed NET capacity is 1,958 MW.

Also,

See link to Wangersky's Telegram article for more Muskrat info:-

http://www.thetelegram.com/Opinion/Columns/2013-01-22/article-3161171/Something%26rsquos-missing-here/1#Comments

15 January 2013

Emera CEO comment regarding Muskrat Falls power (Jan. 10, 2013) : ----- " We have not signed anything that would obligate Nova Scotia customers to take this energy "

http://thechronicleherald.ca/business/410655-taylor-emera-s-growing-power-raises-worries-about-future-bills#.UPSJu8GzhWQ.mailto

12 January 2013

"Even the best design have flaws", Russell Wangersky, The Weekend Telegram

http://www.thetelegram.com/Opinion/Columns/2013-01-12/article-3155251/Even-the-best-design-have-flaws/1

COMMENT MADE BY WINSTON ADAMS on the above-noted article:-

Winston Adams- January 12, 2013 at 14:10:37 Russell, you say, as to whether we actually NEED the power from Muskrat Falls, "the question has never been objectively answered outside of Hydro's own forecasts..... which don't have a great history of accuracy". Now JM, an economist, had a lengthy presentation to the PUB, that the forocast was biased and unreliable. He pointed to our aging and no growth population, being not properly considered. Feehan, another economist put reasoned arguments against the need of more power. Maurice Adams, on his Vision 2041 website has presented the charts of Hydro's flawed forecast record, and has correctly stated that new houses use less energy than old ones, despite being larger. Even economist Wade Locke stated the economics of MF is questionable and subject to the island forecast holding up. Sullivan, Martin and others have questioned the forecast. I filed a submission to the PUB dealing specifically with that issue, showing that efficiency opportunities were substancial. The Telegram later published 3 pieces showing my analysis from an engineering and mathematics perspective that the efficiency potential was 4 times the present average production of Holyrood, and was so economic as to hold steady or decrease costs to consumers. What was not objective about that analysis. I could not engage Nalcor, journalists, media, or MHAs to open up the issue. When you refer to objective analysis you likey mean a significant study, of this and other considerations. Certainly, I could get no details of Nalcor's efficiency considerations before the MF project was sanctioned. Was it a flawed debate by not properly analysing the need for power, before proceeding with the question of what the source of power would be? Certainly it was flawed, and I suggest deliberately so by the government and Nalcor, who preferred to go with MF whether we need the power on the island or not, as the rationale kept changing. Is it like flogging a dead horse to discuss this need for power now? I would say it is late but appropriate to discuss it. Nalcor has just awarded a contract exceeding 100 million for excavation. But Nfld Power is pushing ahead seeking 8.0 percent increase on residential energy rates. Look at their application. See their reduction to normal forecast due to future declining population, and aging population. See the negative impact on power use with the price increase requested, and superimpose this on what effect another 30 or 40 percent increase will do to load growth. You can see Nfld Power's analysis supports the objective statements made by JM and others. Then look at the Application from the perspective of energy efficiency savings. Also note their concern about having little access to alternative power sources, other than Hydro. You will see we are on a path that separates us from all oher progressive utilities. Others put 5 to ten times more resources into the efficiency and conservation approach with real significant benefits for consumers. This Application confirms a path, with little efficiency effort, to prop up power demand.The negative consequences of not doing a comprehensive analysis of whether ne need more power will rattle our economy and worry all power consumers for a long time. This is but the first of many post MF sanction price hikes. Lets brace ourselves for that. It may not be too late, but Nalcor is certainly ramping up expenses. I hope it doesn't turn out like Joey's follies. Certainly,as the costs esculates, more and more it will be asked "did we need that power for the island'. Meanwhile , in Nova Scotia, their Efficiency Corporation is flying the banner "Home Heating Revolution. Oppressed by the high cost of heating your home? Citizens of Nova Scotia- affordability and comfort are yours for the taking!" And yet such a revolution is technically possible much more easily here. So, I suggest, lets kick the dead horse. What harm is that. We need to know if horse is really dead. Electrical power is rated in terms of horses. And 45 percent of our present horsepower is wasted. Our horses have much more to give. With due attention, our electrical horses are far from exhausted. Where is the proof? Where was that objective study? That is the Question.

My comment earlier today (also on Wangersky's article):-

Russel Wangersky's article in today's Weekend Telegram is nicely written.......... I do think however, that he has it backwards --- I would suggest that "The decision on Muskrat Falls, for better or worse, was made" FIRST, ------ THEN "government accepted the premise that electrical consumption in this province would rise — and that there was nothing that could be done to slow that rate of increase." --------- A means to justify the end. ........The decision was made in 2010 (or earlier) and then government set about creating the various and continually changing justifications and rationale for its decision. ... Almost like 'reverse engineering', where you already have the end product, and then you work backwards so as to include all the elements needed to create the product while discarding all those that don't.,,,,,,,, Kennedy's approach in the House was similar ---- where, instead of keeping an open mind while grasping and arriving at an understanding of whether or not Muskrat Falls was the best option, he said instead that he approached Muskrat Falls by FIRST convincing himself that it was the best option and then went about selling it to the people (the very opposite of a rational, scientific, objective approach)....... The process has, from the beginning, been designed to push Muskrat Falls through --- whether it was and is in the best interest of the people and the province ---- or not ----- whether we need the power ----- or not, whether we can afford it --- or not. ........ NONE OF THAT MATTERS ---- PERIOD.

08 January 2013

We all know Brazil is a very rainy/tropical place. However, today's Globe and Mail reports that the stock market there is taking a beating and Brazil is rationing electricity because low rainfall has meant not enough water to run their hydroelectric generation plants. With global warming, where will the hydro potential for Muskrat Falls be in a decade or so?

Also, the Federal Court has today ruled that Metis rights and entitlements come under the jurisdiction of the federal government. How will this impact on Muskrat Falls, in that Muskrat Falls is within NunatuKavut's land claims area, and has Nalcor/government satisfied its aboriginal obligations pursuant to Bil 61?

05 January 2013

It seems that there is a good chance that Muskrat Falls power will never be exported to the U.S.----- the so-called Water Management Agreement between Nalcor and its subsidiary, CFL-Co, (with itself) is highly suspect and may be in conflict with the 1969 Quebec contract ----- the advertised 824 MW of power, which has since been reported to be an average of only 570 MW, is suspect ----------- the forecast demand on which the very viability of Muskrat Falls depends (an island demand of 0.8% compounded yearly FOR 50 YEARS) is suspect -------- the argument that we need MORE POWER is suspect (40% of 570MW is only 228MW ---- which is less than half our already existing installed and only partially used NET capacity of Holyrood --- which is 466MW) --- the rates for Muskrat Falls power is highly suspect and will likely be much HIGHER THAN government is saying (ratepayers MUST PAY whatever is needed to pay the Muskrat Falls multi-billion dollar cost/debt)........ the original cost of $6.2 billion is highly suspect and when interest costs during construction and cost overruns are included will likely be $12 billion or more (it is already up around $9 billion)........ I could go on and on, but in short, Muskrat Falls is unneeded, uneconomic, and needs to be halted pending an objective and detailed review.

04 January 2013

I note that the Sir Robert Bond Papers blog is asking for Consumer Advocate (Tom Johnson) to resign his position.

Why isn't Tom Johnson asking why Nalcor/government will be taking $20 billion in revenue/dividends (over and above Muskrat Falls debt servicing and operating costs) out of the pockets of ratepayers over the next 50 years (according Minister Tom Marshall)?

What rate of return is that for Nalor/government?

Why isn't Tom Johnson speaking up for ratepayers, instead of paying lip-service to the job?

Hydro Quebec has more than the equivalent of Muskrat Falls power (and the Romaine will soon be coming on stream) that will be difficult to sell.

Why isn't Tom Johnson demanding that Nalcor negotiate an early access to Upper Churchill power to meet our needs? Since the market is poor at present for HQ's excess power, don't you think HQ would be willing to provide this province early access to the power we need to get us to 2041? Provided Nalcor would agree to have the equivalent amount of power returned to HQ after 2041 when markets may be better for them?

That would be a win/win situation for both HQ and NL.

NL ratepayers could then save the $29 billion cost (over 50 years) for the Muskrat Falls dam/generation facility (the transmission line cost is only $6 billion over 50 years).

The Muskrat Falls dam/generation facility is a totally unneeded and uneconomic project and should be halted.

26 December 2012

RATEPAYER PROTECTION?

Now that the Public Utilities Board (PUB) is largely out of the picture, how are ratepayers protected?

Is there a need for an independent Ratepayers Association?

The passage of Bill 61 has driven a huge nail in the coffin of ratepayers' rights (and Bill 61 will ensure that there are unnecessarily high electricity bills).

For decades, the Electrical Power Control Act (EPCA) required that the supply, development and distribution of power to consumers would be at "the lowest possible cost consistent with reliable service".

However, Bill 61 has given Cabinet the legislative authority to usurp the rights that ratepayers had previously enjoyed and that were assured by the various provisions of the province's Electrical Power Control Act.

Bill 61 allows Cabinet (at its sole discretion) to direct the Public Utilities Board (PUB) to disregard the EPCA legislated "lowest possible cost" policy requirement (up to now, government has used an "exemption" Order and the "least cost", rather than 'lowest possible cost' slight-of-hand to bypass the 'lowest possible cost' requirement).

Bill 61 now also allows Cabinet (at its sole discretion) to usurp many of the most important rights, authorities, responsibilities and duties of the Public Utilities Board --- thereby effectively neutering the Public Utilities Board, preventing it from protecting the rights (and preventing it from looking out for the best interest) of ratepayers. Now it is ratepayers who must subsidize industrial customers, Nova Scotians and beyond.

Furthermore, the government-appointed Consumer Advocate has been ineffective in preventing these changes (and in fact, supported the Muskrat Falls project and its locked-in, escalating, 50-year, take or pay hidden tax contract).

Accordingly, in order to protect householders/ratepayers, is it now time for an independent "Ratepayers Association", an organization properly structured, ratepayer-funded and managed, and that will stand up for ratepayers' rights --- stand up for their best interests?

A Ratepayers Association could not only lobby government and represent ratepayers at PUB hearings, but a Ratepayers Association would be able to provide information and advice to ratepayers on a range of energy related legislative, regulatory, policy and pricing matters, from "Cost of Service" vs "Power Purchase Agreement" (take or pay) pricing schemes, best practices (engineering, reliability, etc.), other power options, new technologies, energy efficiency, proposed rate increases, demand forecasts, government energy conservation programs, etc., etc.

There are approximately 240,000 households/ratepayers in the province, and a not-for-profit Ratepayers Association (with a board of directors responsible solely to ratepayers), funded perhaps through a small annual fee of $5 to $10, would have considerable influence and would be able to help ensure that ratepayers' rights (and best interests) are represented and protected.

Unchallenged, NL ratepayers will be on the receiving end of a Muskrat Falls, multi-billion dollar TAX GRAB. Ratepayers will subsidize power (for at least 35 years) to mining companies, to the Maritime provinces and potentially to the eastern U.S.

There are better (and lower cost) power supply, development and distribution options, options that are potentially able to provide ratepayers with decreasing, rather than yearly escalating, locked-in prices for 50 years (there are ways that householders/ratepayers can on average pay a thousand, and perhaps even several thousand dollars each and every year LESS THAN the BILLIONS (cumulatively) that Minister Marshall says Muskrat Falls will take out of the pockets of ratepayers over the next 50 years).

The info-graphic below shows that over the next 50 years Nalcor/Government will extract (UNNECESSARILY) about $35 billion from ratepayers' pockets, their children, and grandchildren --- and Premier Dunderdale is also now hinting at higher taxes (most likely on low and middle income earners) in order to deal with the province's deficit, a large part of which is caused by Muskrat Falls.

So --- is exploring the need for an independent Ratepayers Association a worthwhile endeavour?

Or is there another way to shed light on, and lessen the impact of, Muskrat Madness?

CLICK IMAGE TO ENLARGE

|

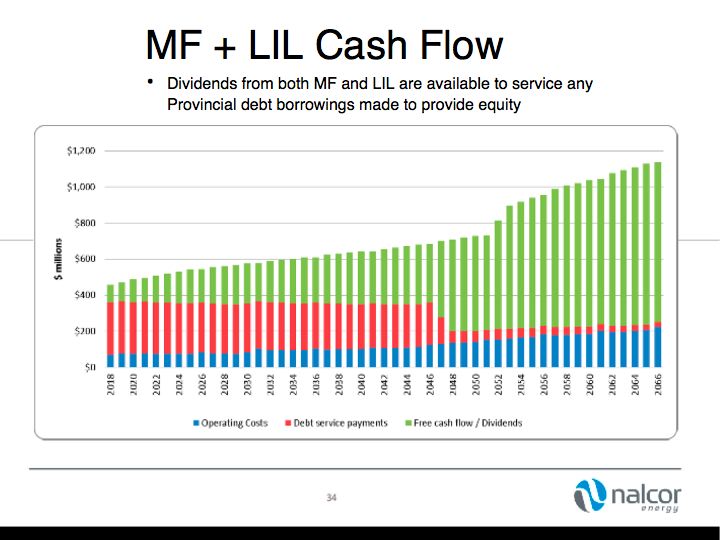

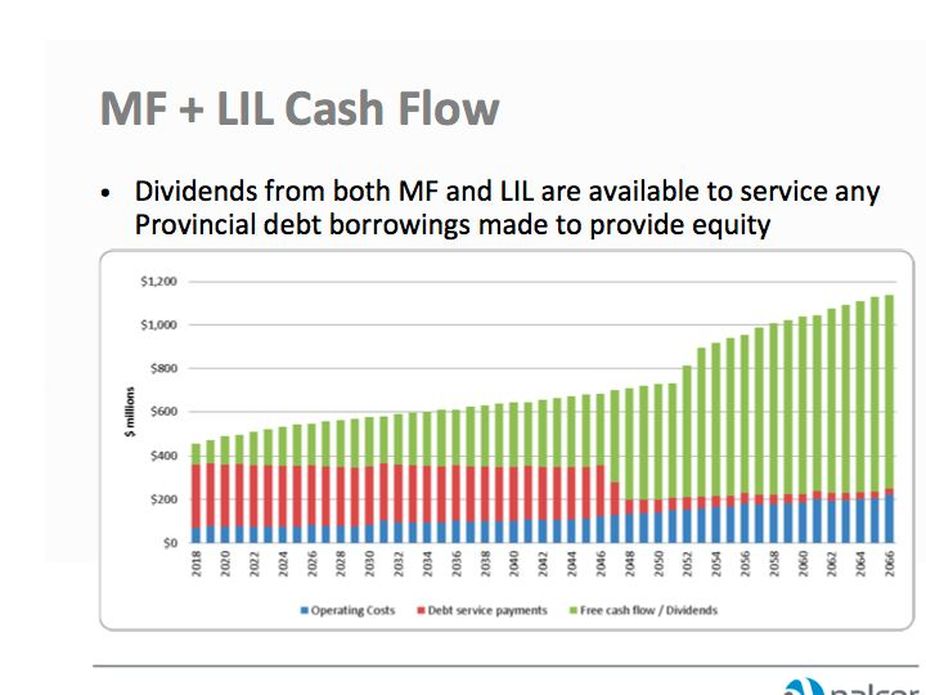

The Muskrat Falls graphic (left) is from one of Nalcor's 2011 media briefings.

Last week Minister Marshall, in the House of Assembly, said that over the 50-year period shown here Nalcor/Government would receive $20 billion in "revenue" from ratepayers (the GREEN section) --- the $20 billion in "revenue" is over and above the additional $15 billion (the RED and BLUE sections) that is needed from ratepayers to cover Muskrat Falls' debt servicing and operating costs (an unabashed TAX GRAB). On average, these total MF revenues (from ratepayers) amount to about $700 million per year for 50 years, or about an additional $3,000.00 per household/ ratepayer per year (note the dramatic increase in the last 20 years) By way of comparison, from 2001-2010, oil costs for Holyrood averaged $92 million per year --- about $380 per household/ratepayer per year). So what impact do you think that change will have on your electricity bill --- a whole lot more than $5 to $10 a year? Who is looking out for your interest? |

24 December 2012

Muskrat Madness: http://bondpapers.blogspot.ca/2012/12/not-with-bang-but-whimper-nlpoli.html

23 December 2012

A MUST READ article by Dennis Woodrow Burden "Why am I here?", Labrador http://rethinkmuskratfalls.wordpress.com/2012/12/18/why_am_i_here/

The Telegram editorial of 22 December 2012 http://www.thetelegram.com/Opinion/Editorial/2012-12-22/article-3146156/One-question/1 suggests that Bill 61 prevents even retailers and industrial customers from building (and utilizing) even their own sources of electrical power.

22 December 2012

"Snowstorm leaves 100,000 homes, businesses without power in Quebec"

http://www.theglobeandmail.com/news/national/snowstorm-leaves-100000-homes-businesses-without-power-in-quebec/article6689741/

-------------------------

Bill 61 has been passed by the House.

I would say that while it would have been more difficult for the Opposition parties to have dissected the Muskrat Falls project in as detailed a way over the last several months as they did this week, nevertheless, they could have done so long before now.

This weeks very good work seems to have been too little, too late.

If they had been more critical earlier and provided more leadership to their people, polls showing that the people supporting Muskrat Falls may have been significantly different. So I place at least some share of the blame on the opposition (recognizing of course that government kept them out of the picture, kept changing the picture, refused committee analysis, provided little or no notice for legislation, etc, etc.).

It is the opposition's job to oppose, and at the political level there was virtually no opposition to Muskrat Falls with the exception to the week before Christmas when citizens would not have had the time to be paying attention.

Not a good 2 years for democracy. Not a good project for the people. Not a good 50 years for our children and grand children. After the Upper Churchill project fiasco, we should all be ashamed of ourselves.

21 December 2021

Excerpt from Bill 61

(2) The Lieutenant-Governor in Council may designate any activities, agreements and amendments in connection with or in respect of subsection (1) entered into by the corporation, a subsidiary of the corporation, Newfoundland and Labrador Hydro, and Emera Inc., whether individually or by any combination of them (a) to be included as part of the Muskrat Falls Project where that activity, agreement or amendment may not otherwise qualify under this section;

This would appear to allow government to put assets, other than the more precisely existing definition of MF assets, up as security and thereby place other NL assets at risk in order to get financing ---- and there is NO LIMIT on what government can pledge. This Premier no doubt has a Plan B that includes placing the Confederation Building up for security in order to get the financing. Now I know why $50 million is being spent to spruce up our seat of government --- it will, in all likelihood, be needed as collateral.

------------------------

Comment today from James G. Learning on The Telegram website in relation the Brian Jones's article: http://www.thetelegram.com/Opinion/Columns/2012-12-21/article-3145210/More-nonsense-from-the-power-crowd/1

James G. Learning- December 21, 2012 at 16:53:25

"It's no secret by now that NunatuKavut and Nunatseavut oppose this project, first because it's not for Labrador. Second because it will poison our waters, and the food in it. Clap trap about mining revenues and deals aside, becaues they are asides, were never in the original justification. I don't honestly remember what was in which Justification. So, all of that aside, the two ineffective Aboriginal groups I hope will be on the front lines to stop this fiasco, and save the NL rate payer. My call would be to other Non-Aboriginal rate payers, come with us on the front lines, you will never regret it. This Island and Territory need to be saved from this Willams/Dunderdale horror. Every drop of oil revenues, every rock in Labrador will be savaged to pay for this fiasco. I can't imagine anyone listening to Maurice Adams factuals, and still be confused. Like the man said now we are truly Canadian, why because we are about to be in tax hell, I don't think thats where the average Canadian is. I lived and worked in Alberta for over 25 years, the tax rate was a dream. They are Canadians. So what is that statement all about. More clap trap, no doubt. It would appear if the NL Government can't do anything right, it can't do anything. The Newfoundland history is one of failed governments, here we go again. Only difference is this time everyones eyes are wide shut."

A 7th amendment is proposed --- to close Holyrood "in a timely manner" ---- ruled by the Speaker as "not in order"

A 6th amendment by the Liberals has been ruled in order. The amendment (if passed by government) would allow for meaningful consultation with Labrador Aboriginal groups.

A 5th attempt by the Liberals to amend the legislation, in this case to allow the private sector to develop cheaper or alternative power to Muskrat Falls has been ruled "out of order"

For the 4th time today, the Speaker has ruled a proposed information related amendment to Muskrat Falls legislation --- "out of order" ---- we -- the public of NL are NOT ALLOWED, through OUR PUB, to have access to expenses and cost and revenue information related to Muskrat Falls ------ It is NOT the "Cabinet's" Utilities Board, it is the "Public's" Utilities Board. What is in this Bill 61 that government do not want the public to know?

For the 3rd time today, the Speaker has ruled an amendment by the Liberals ----- "out of order" (an amendment related to the PUB accessing information related to Muskrat Falls).

For the 2nd time today, the Speaker has ruled that another amendment that would require government to use revenue in excess of expenses to be used to reduce rates for ratepayers to be "out of order". What other reason can there be than because the Muskrat legislation is DESIGNED as a TAX GRAB --- and not to keep rates low for ratepayers?

If there was and is any doubt that Bill 61 (Muskrat legislation) was designed by government to be a MASSIVE TAX GRAB, an amendment proposed today to use excess revenue to lower rates for ratepayers was ruled by the Speaker as "out of order" --- which in effect means that the purpose of Bill 61 is not just to provide power to island ratepayers, but to raise money "FOR GOVERNMENT USE" ---- in other words a 'tax grab'. Why else would the Speaker rule the proposed amendment to use excess MF revenues to lower rates out of order?

-------------------------------

The G & M insert today (Eastern Canada's Energy News, Earth Resources), quotes Nova Scotia's Premier Dexter as saying that Muskrat Falls "will lower costs over time because Nova Scotia will have a frozen price for energy for 35 years" ---- while NL ratepayers will be locked in to an annual 2% escalating rate increase for 50 years.------- The premier then goes on to say that "just imagine yourself if you could buy electricity today at 1995 rates. Here's a real interesting piece. You can imagine energy passing through Nova Scotia going to New England. We would be able to buy off of that line at the New England price, minus the transmission cost...and if they (NL) transmit, they pay a wheeling rate to Nova Scotia Power across the transmission lines that then has to be taken into account as income for the purpose of calculating the rate of return for Nova Scotia Power. Either way, (Nova Scotia) ratepayers benefit" -------and I would say that,.... either way, NL ratepayers lose.

-----------------------------------

In the House today, I would say that "even the Liberals are salivating at the time when they can form the government and then have their turn at setting the electricity rates so that then they too can throw taxpayers' own money around at election time"

Consumers will not even be able to use Upper Churchill power in 2041 (and therefore have no alternative market to Quebec). We will also pay (not including debt servicing and operating costs) 5 times more for our 40% of Muskrat power than Maritimers or ratepayers in the U.S will pay for their 40%). ........Facts, rational thought just does not matter. .........Government sees an opportunity for a multi-billion dollar TAX GRAB from its own citizens --- and it is, by legislation, locking its own citizens into that by way of this ELECTRICITY TAX --- and no one seems to care. ......... Even the Liberals are salivating at the time when they can form the government and then have their turn at setting the electricity rates so that then they too can throw taxpayers own money around at election time --- obtained through this Conservative imposed multi-billion dollar tax grab. ------ If ratepayers do not wish to be FLEECED, they must speak up now --- ALL AIDED AND ABETTED BY OUR 'FRIENDS' IN OTTAWA (HARPERLAND) AND NOVA SCOTIA ----- our situation has not improved.

20 Dec. 2012 --- Island ratepayers pay 5 times more than Maritimers or future U.S. ratepayers.

Just listening to the House. Government confirms that revenues received from island ratepayers for the 40% of Muskrat Falls power that they will use ($20 billion) will be 5 times more than the revenues received from the export sale of the other 40% of Muskrat Falls power ($4 billion). Or, to put it another way, island ratepayers will pay 5 times more for their 40% of Muskrat Falls power than Maritime or U.S. ratepayers will pay for theirs 40%. Actually, more than that because on top of that $20 billion, island ratepayers will also pay for the operating and debt service costs as well (which is not included in the $20 billion figure).

"Muskrat Folly" -- The Financial Post - http://opinion.financialpost.com/2012/12/18/muskrat-folly/

MUST READ

Excerpt from Sir Robert Bond Papers blog:

"...changes to the (Electrical Power Control) Act will allow cabinet to dictate electricity prices in the province. The changes to the bill ensure that Nalcor can prevent development of cheaper alternatives to Muskrat Falls, including purchasing electricity from outside the province for use on the island. It also voids any contracts that may exist before the changes come into force."

Government is changing the province's Electrical Power Control Act to prevent the private sector from developing and/or supplying any power to customers on the island that could undercut Muskrat Falls' prices. Please link to Ed Hollett's Sir Robert Bond Papers: http://bondpapers.blogspot.ca/2012/12/a-closed-market-nlpoli.html

17 Dec, 2012 --- In the House today government is saying that the mining companies in Labrador need 'certainty' in their electricity rates, so the government is debating an industrial rate for Labrador that in 2017 will be 2.7 cents / KWh, while the cost for Muskrat Falls power will be around 30-40 cents/KWh.

And recently, it has been reported that Alderon will spend $3.8 million for pre-engineering work so that Nalcor might provide transmission lines to facilitate power to western Labrador mining. By way of comparison, ratepayers share of the cost of Muskrat Falls over 50 years will be about 10,000 times greater than Alderon's expenditure of $3.8 million.

----------------------------------------------------------------------------------------------------------------------

The 824 MW number that Nalcor quotes for Muskrat Falls comes from the manufacturer's rating on the metal plate that is on each of the 4 turbines planned for the generation facility (206 MW each)............ However, Nalcor says that the average output will be 570 MW (determined by the water flow). .........Nalcor says we need 40% of MF power for the island. That equals 228 MW (less than half Holyrood's already exisiting NET capacity of 466 MW --- and which operates on average at less than 30% its capacity and provides only 12% of the island's total energy needs).

How then can we need MORE power, when the 40% of Muskrat Falls power (228 MW) give the island 50% LESS POWER than Holyrood's 466 MW? ---- And we will pay $10 billion for LESS POWER than we have now ($35 billion over 40 years)?

Why are we allowing government to drown us in debt, waste our oil revenues, put a hold on public services, place the control and ownership of our resources at risk, weigh each homeowner down with debt for 50 years based on what Nalcor says is increasing residential demand --- when government 's own two 2011 studies (Energy Efficiency and Climate Change Action Plans) both state clearly and firmly that residential energy demand has GONE DOWN 17% over the last 19 years?

This is a travesty that homeowners and parents should not allow to happen.

-----------------------------------------------------------------------------------------

Excerpt from 13 Dec. 2012 NL Government News Release:

“Muskrat Falls is a project that will ... be a major revenue generator for the province as we diversify our economy. We estimate that the province will see revenues in excess of $20 billion over 50 years beginning in 2017, with average annual revenues of $450 million over this period”

Please scroll down and see Nalcor's info-graphic where that so-called 'revenue' can be seen.

That $20 billion 'revenue' (PLUS $15 billion more in debt servicing and operating costs) comes solely out of the pockets of island ratepayers ---- that is the REVENUE of which government speaks.

It is a backdoor TAX GRAB from island ratepayers --- going into government coffers, and government and Nalcor touts it as "revenue".

Muskrat Madness: http://bondpapers.blogspot.ca/2012/12/not-with-bang-but-whimper-nlpoli.html

23 December 2012

A MUST READ article by Dennis Woodrow Burden "Why am I here?", Labrador http://rethinkmuskratfalls.wordpress.com/2012/12/18/why_am_i_here/

The Telegram editorial of 22 December 2012 http://www.thetelegram.com/Opinion/Editorial/2012-12-22/article-3146156/One-question/1 suggests that Bill 61 prevents even retailers and industrial customers from building (and utilizing) even their own sources of electrical power.

22 December 2012

"Snowstorm leaves 100,000 homes, businesses without power in Quebec"

http://www.theglobeandmail.com/news/national/snowstorm-leaves-100000-homes-businesses-without-power-in-quebec/article6689741/

-------------------------

Bill 61 has been passed by the House.

I would say that while it would have been more difficult for the Opposition parties to have dissected the Muskrat Falls project in as detailed a way over the last several months as they did this week, nevertheless, they could have done so long before now.

This weeks very good work seems to have been too little, too late.

If they had been more critical earlier and provided more leadership to their people, polls showing that the people supporting Muskrat Falls may have been significantly different. So I place at least some share of the blame on the opposition (recognizing of course that government kept them out of the picture, kept changing the picture, refused committee analysis, provided little or no notice for legislation, etc, etc.).

It is the opposition's job to oppose, and at the political level there was virtually no opposition to Muskrat Falls with the exception to the week before Christmas when citizens would not have had the time to be paying attention.

Not a good 2 years for democracy. Not a good project for the people. Not a good 50 years for our children and grand children. After the Upper Churchill project fiasco, we should all be ashamed of ourselves.

21 December 2021

Excerpt from Bill 61

(2) The Lieutenant-Governor in Council may designate any activities, agreements and amendments in connection with or in respect of subsection (1) entered into by the corporation, a subsidiary of the corporation, Newfoundland and Labrador Hydro, and Emera Inc., whether individually or by any combination of them (a) to be included as part of the Muskrat Falls Project where that activity, agreement or amendment may not otherwise qualify under this section;

This would appear to allow government to put assets, other than the more precisely existing definition of MF assets, up as security and thereby place other NL assets at risk in order to get financing ---- and there is NO LIMIT on what government can pledge. This Premier no doubt has a Plan B that includes placing the Confederation Building up for security in order to get the financing. Now I know why $50 million is being spent to spruce up our seat of government --- it will, in all likelihood, be needed as collateral.

------------------------

Comment today from James G. Learning on The Telegram website in relation the Brian Jones's article: http://www.thetelegram.com/Opinion/Columns/2012-12-21/article-3145210/More-nonsense-from-the-power-crowd/1

James G. Learning- December 21, 2012 at 16:53:25

"It's no secret by now that NunatuKavut and Nunatseavut oppose this project, first because it's not for Labrador. Second because it will poison our waters, and the food in it. Clap trap about mining revenues and deals aside, becaues they are asides, were never in the original justification. I don't honestly remember what was in which Justification. So, all of that aside, the two ineffective Aboriginal groups I hope will be on the front lines to stop this fiasco, and save the NL rate payer. My call would be to other Non-Aboriginal rate payers, come with us on the front lines, you will never regret it. This Island and Territory need to be saved from this Willams/Dunderdale horror. Every drop of oil revenues, every rock in Labrador will be savaged to pay for this fiasco. I can't imagine anyone listening to Maurice Adams factuals, and still be confused. Like the man said now we are truly Canadian, why because we are about to be in tax hell, I don't think thats where the average Canadian is. I lived and worked in Alberta for over 25 years, the tax rate was a dream. They are Canadians. So what is that statement all about. More clap trap, no doubt. It would appear if the NL Government can't do anything right, it can't do anything. The Newfoundland history is one of failed governments, here we go again. Only difference is this time everyones eyes are wide shut."

A 7th amendment is proposed --- to close Holyrood "in a timely manner" ---- ruled by the Speaker as "not in order"

A 6th amendment by the Liberals has been ruled in order. The amendment (if passed by government) would allow for meaningful consultation with Labrador Aboriginal groups.

A 5th attempt by the Liberals to amend the legislation, in this case to allow the private sector to develop cheaper or alternative power to Muskrat Falls has been ruled "out of order"

For the 4th time today, the Speaker has ruled a proposed information related amendment to Muskrat Falls legislation --- "out of order" ---- we -- the public of NL are NOT ALLOWED, through OUR PUB, to have access to expenses and cost and revenue information related to Muskrat Falls ------ It is NOT the "Cabinet's" Utilities Board, it is the "Public's" Utilities Board. What is in this Bill 61 that government do not want the public to know?

For the 3rd time today, the Speaker has ruled an amendment by the Liberals ----- "out of order" (an amendment related to the PUB accessing information related to Muskrat Falls).

For the 2nd time today, the Speaker has ruled that another amendment that would require government to use revenue in excess of expenses to be used to reduce rates for ratepayers to be "out of order". What other reason can there be than because the Muskrat legislation is DESIGNED as a TAX GRAB --- and not to keep rates low for ratepayers?

If there was and is any doubt that Bill 61 (Muskrat legislation) was designed by government to be a MASSIVE TAX GRAB, an amendment proposed today to use excess revenue to lower rates for ratepayers was ruled by the Speaker as "out of order" --- which in effect means that the purpose of Bill 61 is not just to provide power to island ratepayers, but to raise money "FOR GOVERNMENT USE" ---- in other words a 'tax grab'. Why else would the Speaker rule the proposed amendment to use excess MF revenues to lower rates out of order?

-------------------------------

The G & M insert today (Eastern Canada's Energy News, Earth Resources), quotes Nova Scotia's Premier Dexter as saying that Muskrat Falls "will lower costs over time because Nova Scotia will have a frozen price for energy for 35 years" ---- while NL ratepayers will be locked in to an annual 2% escalating rate increase for 50 years.------- The premier then goes on to say that "just imagine yourself if you could buy electricity today at 1995 rates. Here's a real interesting piece. You can imagine energy passing through Nova Scotia going to New England. We would be able to buy off of that line at the New England price, minus the transmission cost...and if they (NL) transmit, they pay a wheeling rate to Nova Scotia Power across the transmission lines that then has to be taken into account as income for the purpose of calculating the rate of return for Nova Scotia Power. Either way, (Nova Scotia) ratepayers benefit" -------and I would say that,.... either way, NL ratepayers lose.

-----------------------------------

In the House today, I would say that "even the Liberals are salivating at the time when they can form the government and then have their turn at setting the electricity rates so that then they too can throw taxpayers' own money around at election time"

Consumers will not even be able to use Upper Churchill power in 2041 (and therefore have no alternative market to Quebec). We will also pay (not including debt servicing and operating costs) 5 times more for our 40% of Muskrat power than Maritimers or ratepayers in the U.S will pay for their 40%). ........Facts, rational thought just does not matter. .........Government sees an opportunity for a multi-billion dollar TAX GRAB from its own citizens --- and it is, by legislation, locking its own citizens into that by way of this ELECTRICITY TAX --- and no one seems to care. ......... Even the Liberals are salivating at the time when they can form the government and then have their turn at setting the electricity rates so that then they too can throw taxpayers own money around at election time --- obtained through this Conservative imposed multi-billion dollar tax grab. ------ If ratepayers do not wish to be FLEECED, they must speak up now --- ALL AIDED AND ABETTED BY OUR 'FRIENDS' IN OTTAWA (HARPERLAND) AND NOVA SCOTIA ----- our situation has not improved.

20 Dec. 2012 --- Island ratepayers pay 5 times more than Maritimers or future U.S. ratepayers.

Just listening to the House. Government confirms that revenues received from island ratepayers for the 40% of Muskrat Falls power that they will use ($20 billion) will be 5 times more than the revenues received from the export sale of the other 40% of Muskrat Falls power ($4 billion). Or, to put it another way, island ratepayers will pay 5 times more for their 40% of Muskrat Falls power than Maritime or U.S. ratepayers will pay for theirs 40%. Actually, more than that because on top of that $20 billion, island ratepayers will also pay for the operating and debt service costs as well (which is not included in the $20 billion figure).

"Muskrat Folly" -- The Financial Post - http://opinion.financialpost.com/2012/12/18/muskrat-folly/

MUST READ

Excerpt from Sir Robert Bond Papers blog:

"...changes to the (Electrical Power Control) Act will allow cabinet to dictate electricity prices in the province. The changes to the bill ensure that Nalcor can prevent development of cheaper alternatives to Muskrat Falls, including purchasing electricity from outside the province for use on the island. It also voids any contracts that may exist before the changes come into force."

Government is changing the province's Electrical Power Control Act to prevent the private sector from developing and/or supplying any power to customers on the island that could undercut Muskrat Falls' prices. Please link to Ed Hollett's Sir Robert Bond Papers: http://bondpapers.blogspot.ca/2012/12/a-closed-market-nlpoli.html

17 Dec, 2012 --- In the House today government is saying that the mining companies in Labrador need 'certainty' in their electricity rates, so the government is debating an industrial rate for Labrador that in 2017 will be 2.7 cents / KWh, while the cost for Muskrat Falls power will be around 30-40 cents/KWh.

And recently, it has been reported that Alderon will spend $3.8 million for pre-engineering work so that Nalcor might provide transmission lines to facilitate power to western Labrador mining. By way of comparison, ratepayers share of the cost of Muskrat Falls over 50 years will be about 10,000 times greater than Alderon's expenditure of $3.8 million.

----------------------------------------------------------------------------------------------------------------------

The 824 MW number that Nalcor quotes for Muskrat Falls comes from the manufacturer's rating on the metal plate that is on each of the 4 turbines planned for the generation facility (206 MW each)............ However, Nalcor says that the average output will be 570 MW (determined by the water flow). .........Nalcor says we need 40% of MF power for the island. That equals 228 MW (less than half Holyrood's already exisiting NET capacity of 466 MW --- and which operates on average at less than 30% its capacity and provides only 12% of the island's total energy needs).

How then can we need MORE power, when the 40% of Muskrat Falls power (228 MW) give the island 50% LESS POWER than Holyrood's 466 MW? ---- And we will pay $10 billion for LESS POWER than we have now ($35 billion over 40 years)?

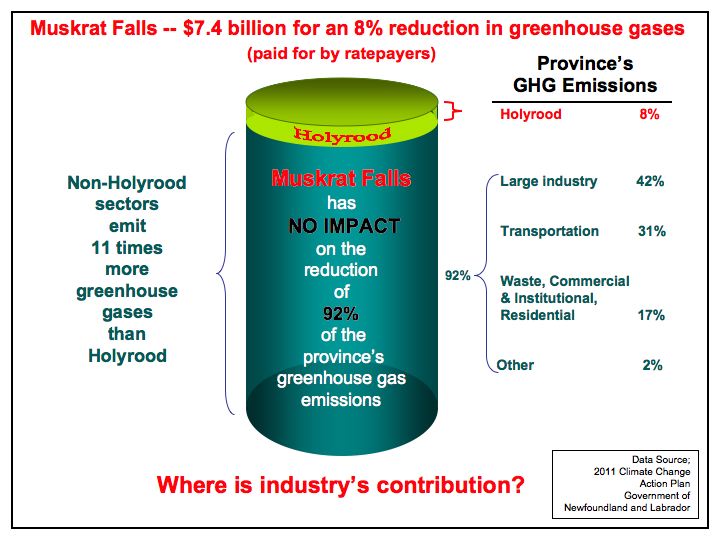

Why are we allowing government to drown us in debt, waste our oil revenues, put a hold on public services, place the control and ownership of our resources at risk, weigh each homeowner down with debt for 50 years based on what Nalcor says is increasing residential demand --- when government 's own two 2011 studies (Energy Efficiency and Climate Change Action Plans) both state clearly and firmly that residential energy demand has GONE DOWN 17% over the last 19 years?

This is a travesty that homeowners and parents should not allow to happen.

-----------------------------------------------------------------------------------------

Excerpt from 13 Dec. 2012 NL Government News Release:

“Muskrat Falls is a project that will ... be a major revenue generator for the province as we diversify our economy. We estimate that the province will see revenues in excess of $20 billion over 50 years beginning in 2017, with average annual revenues of $450 million over this period”

Please scroll down and see Nalcor's info-graphic where that so-called 'revenue' can be seen.

That $20 billion 'revenue' (PLUS $15 billion more in debt servicing and operating costs) comes solely out of the pockets of island ratepayers ---- that is the REVENUE of which government speaks.

It is a backdoor TAX GRAB from island ratepayers --- going into government coffers, and government and Nalcor touts it as "revenue".

NEWS RELEASE today from the Government of Newfoundland and Labrador (note that this is NOT a "loan guarantee", but instead merely a "term sheet" agreement --- i.e. an agreement on the terms from which a loan guarantee may or may not emerge). http://www.releases.gov.nl.ca/releases/2012/nr/1203n04.htm

------------------------------------------------------------------------------------------------------------------------------------------------------

05 Dec. 2012 (Globe and Mail) --- "Quebec has no reason to fear the Muskrat Falls project"

http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/quebec-has-no-reason-to-fear-the-muskrat-falls-project/article5980909/

BRAD CABANA'S "Saving Private Peter"

http://rocksolidpolitics.blogspot.ca/

Today's, 01 Dec. 2012 Telegram poll now shows 56% of ratepayers want a referendum (UP from an earlier NTV poll?) and also that 61% of women now want a referendum (also UP from earlier poll).

Also, 01 Dec. 2012 Globe and Mail article quotes Emera CEO as saying that the Maritime Link is now estimated to cost up to $1.5 billion (25% more). So, $7.4 billion is now up to $7.7 billion http://www.theglobeandmail.com/news/politics/muskrat-falls-project-secures-federal-loan-guarantee/article5844544/

Loan Guarantee only a 'term sheet". See Des Sullivan's blog (Also, it seems a real guarantee is dependent on a link to Nova Scotia, which is unlikely).

http://unclegnarley.blogspot.ca/2012/12/the-pm-to-dunderdale-take-it-or-leave-it.html#more

Quebec vows to fight federal government funding (what will that do to Nalcor's so-called Water Management Agreement?)

http://www.theglobeandmail.com/news/politics/quebec-warns-it-will-fight-federal-funding-of-newfoundland-energy-project/article5842575/

Please note that most demand-related information is now on a separate DEMAND page (above).

28 Nov. 2012.

Globe and Mail:---- "Pierre Duhaime, former SNC-Lavalin CEO, arrested on fraud charges".

------------------------------------------------------------------------------------------------

(See DEMAND page for links to Energy and Climate Change Plans).