25 April 2018

Following email from Nalcor:

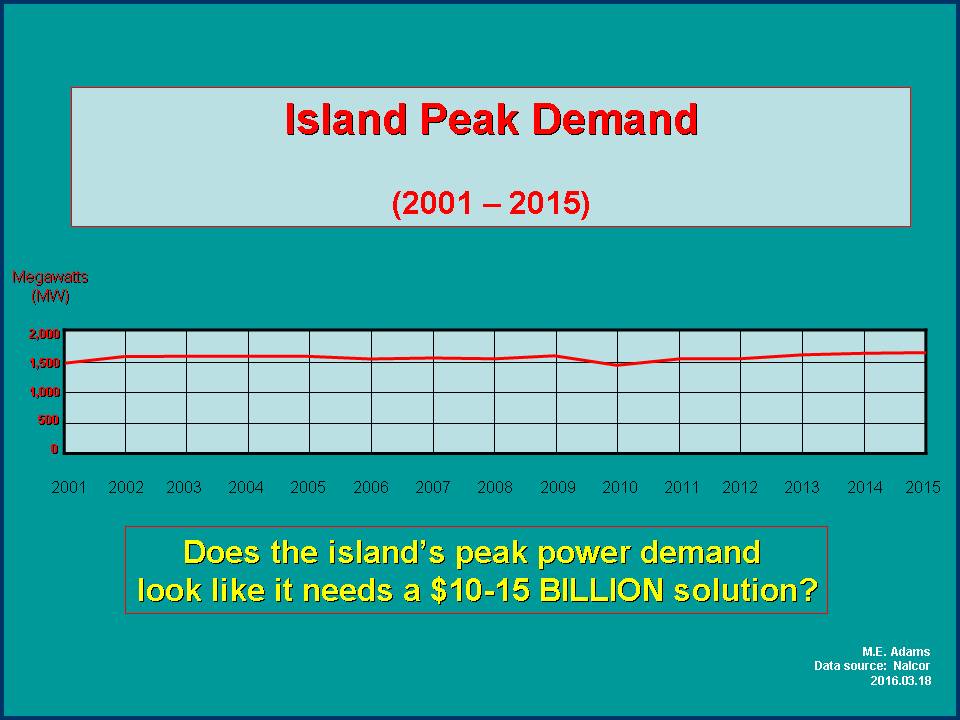

The energy and peak demand statistics for the Island Interconnected System (IIS) for 2017 are as follows:

1. Actual 2017 energy requirements for the IIS were 8415.6 gigawatthours and includes the system energy requirements to serve Newfoundland Power, Newfoundland & Labrador Hydro's rural island interconnected regions and Island industrial operations. The weather adjusted energy requirement for the IIS for 2017 is estimated at 8416.1 gigawatthours.

2. The measured peak demand for the IIS for the 2017/2018 winter peak period (December through March) was 1648 megawatts and occurred on December 27, 2017 at 16:42. Customer demand at the time of the peak was reduced by an industrial customer load curtailment that had been requested by Newfoundland & Labrador Hydro.

20 May 2017

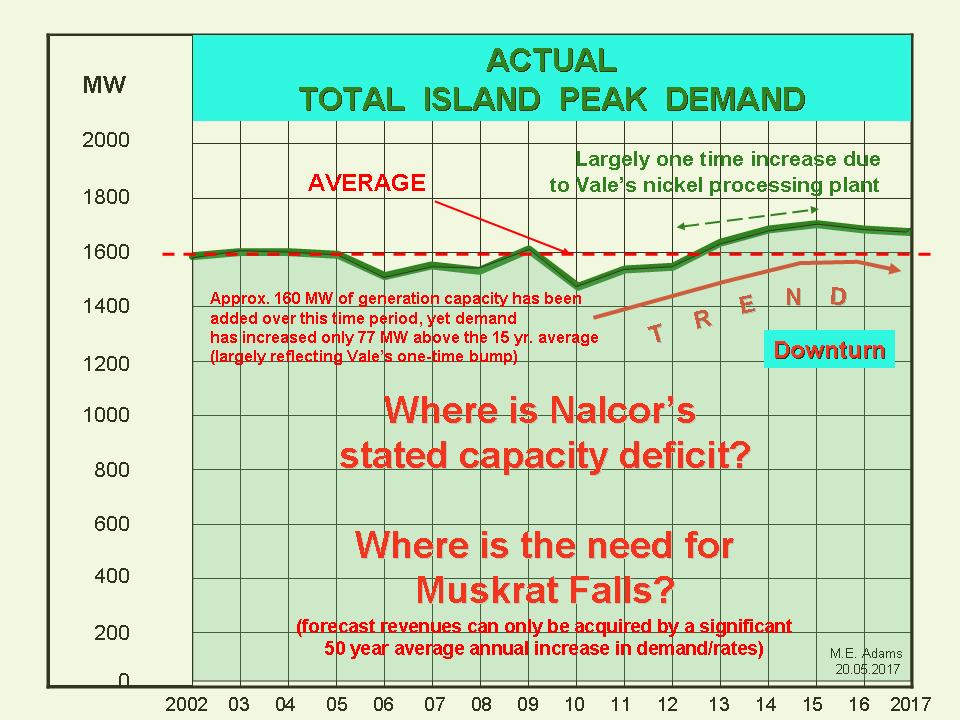

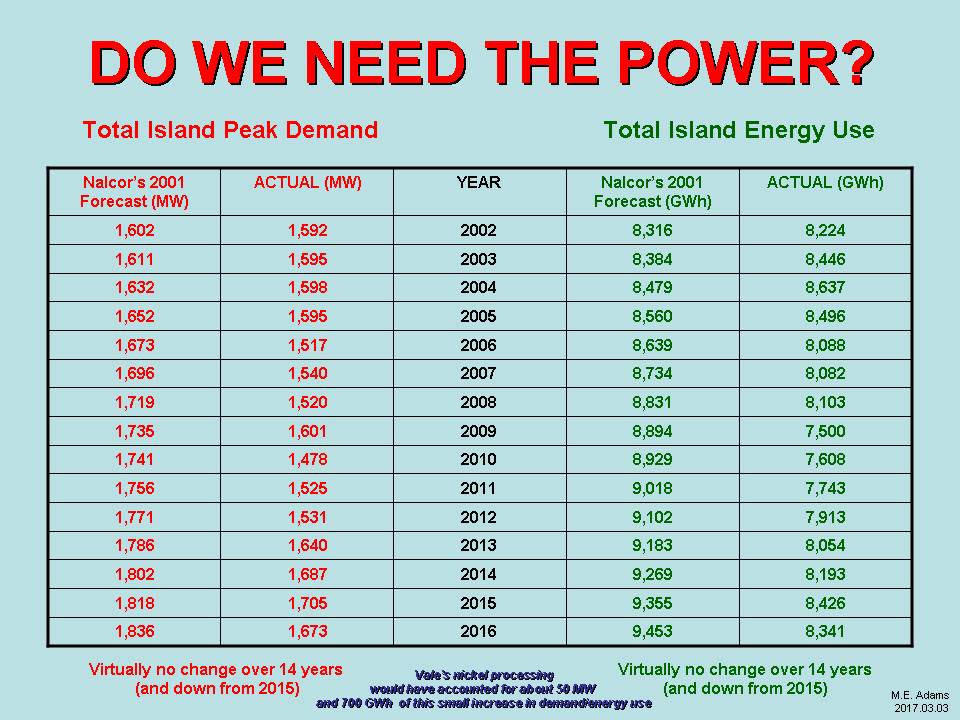

DO WE NEED THE POWER?

DO WE NEED THE POWER?

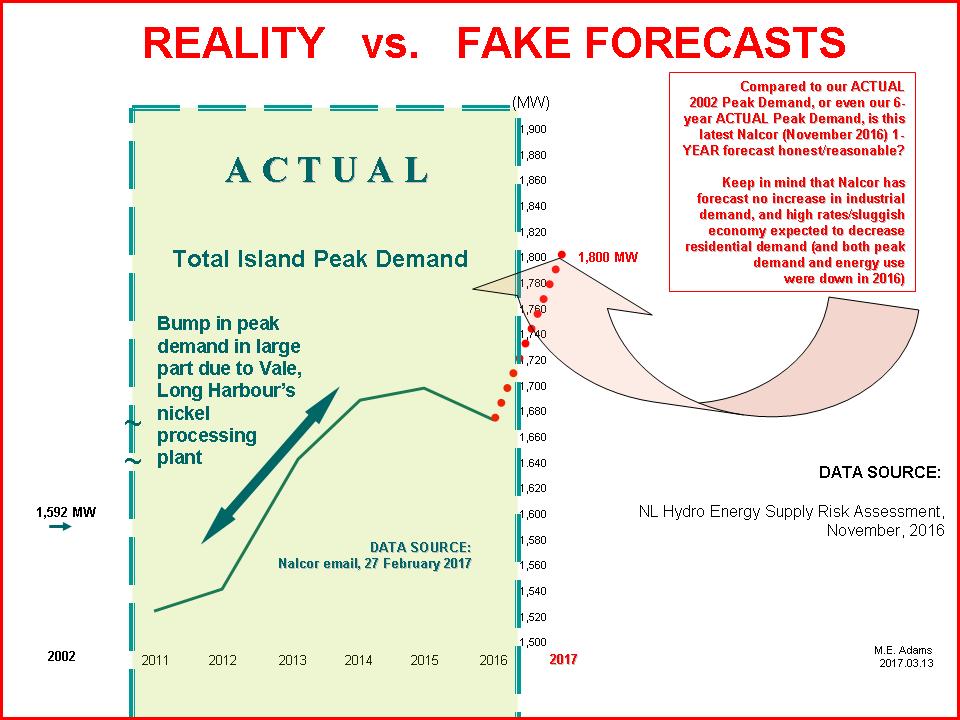

13 March 2017

DO WE NEED THE POWER?

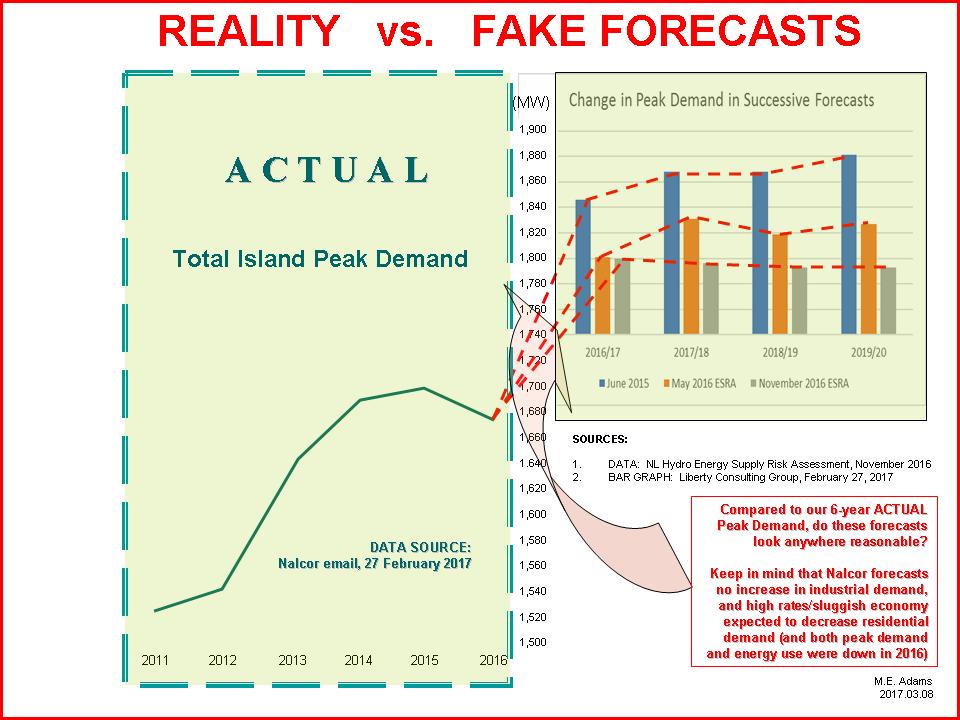

08 March 2017

DO WE NEED THE POWER?

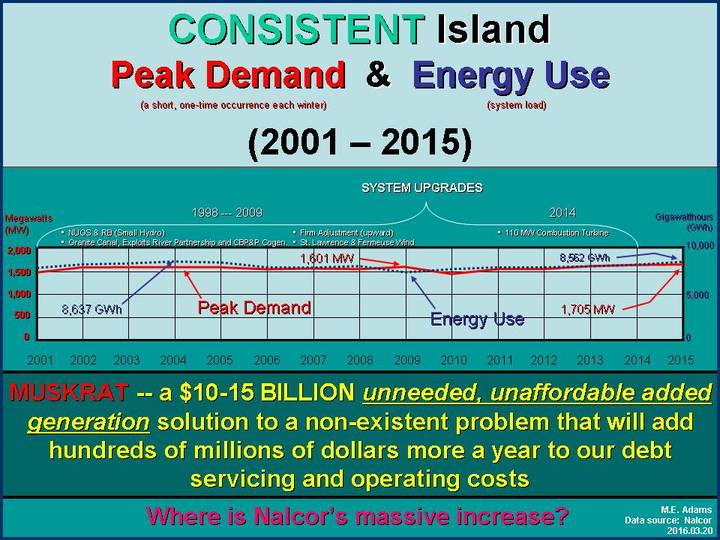

03 March 2017

|

23 March 2014

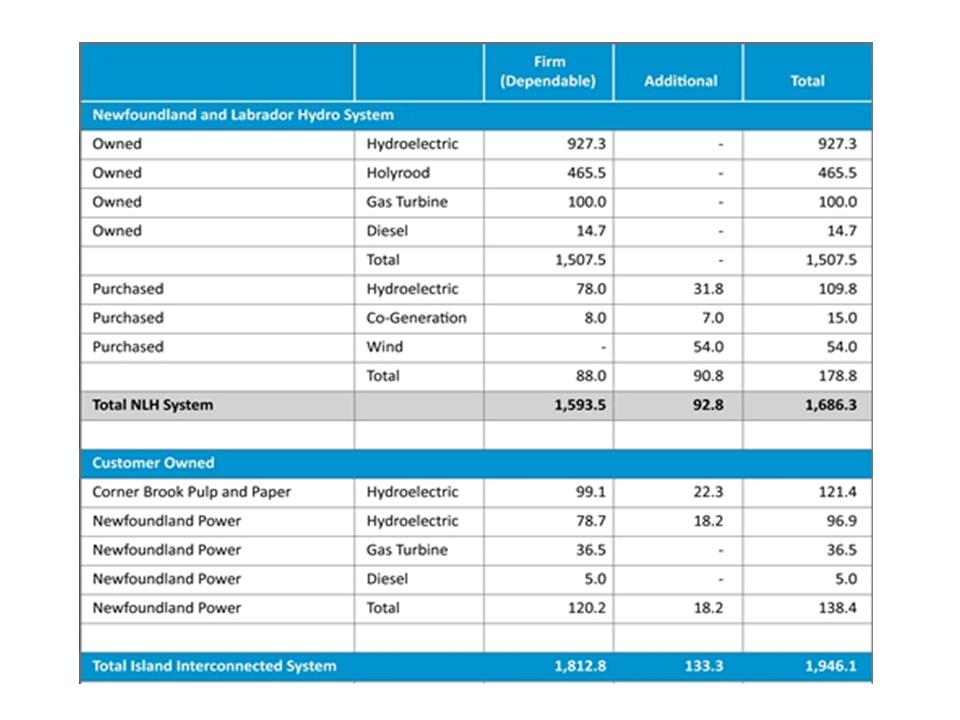

How is it that all during the Muskrat Falls PUB review, Nalcor consitently reported Total Island Firm Capacity as 1,958MW, and now Nalcor is reporting it as 1,813 MW?

Where did 145 MW of firm capacity disappear to?

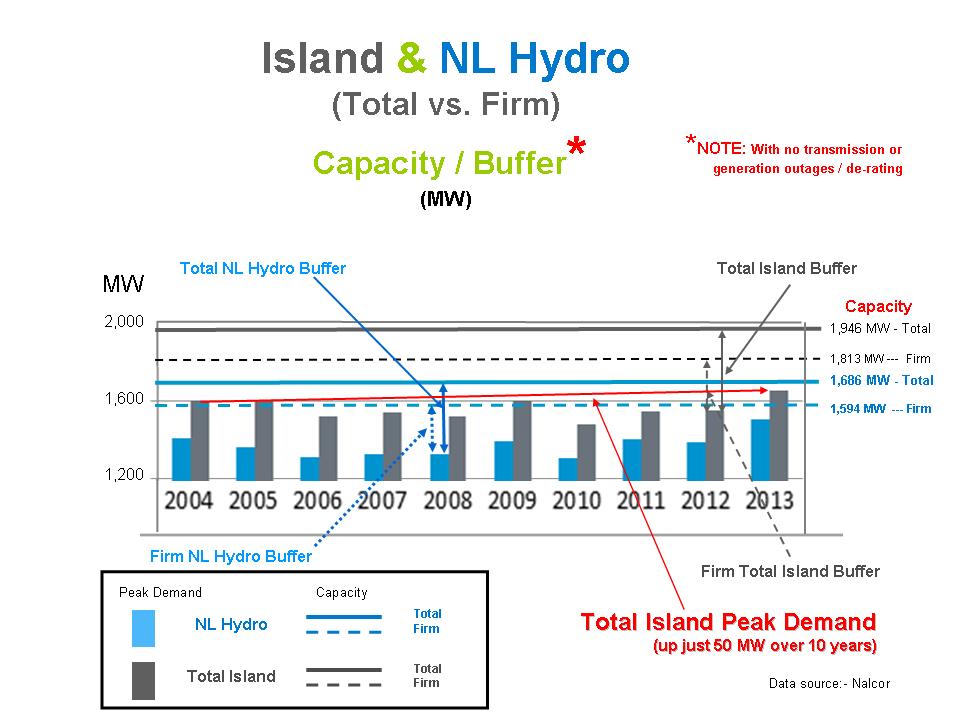

Even still, you will note that for 2013 Total Island Firm Capacity was still almost 200 MW ABOVE the Total Island Peak Demand, and back in 2004 it was not much more --- at just over 200 MW above (a mere ~ 50 MW change over 10 years).

How is it that all during the Muskrat Falls PUB review, Nalcor consitently reported Total Island Firm Capacity as 1,958MW, and now Nalcor is reporting it as 1,813 MW?

Where did 145 MW of firm capacity disappear to?

Even still, you will note that for 2013 Total Island Firm Capacity was still almost 200 MW ABOVE the Total Island Peak Demand, and back in 2004 it was not much more --- at just over 200 MW above (a mere ~ 50 MW change over 10 years).

|

NOTE:-- For 2013 the non-NL Hydro portion of Peak Demand (top portion of grey area) is only about HALF that for each of the pre-2009 years (down considerably). Why then isn't more of the Island "total" and "firm" capacity available to supplement NL Hydro capacity? Or is it? If it is not available, why not?

|

20 April 2013

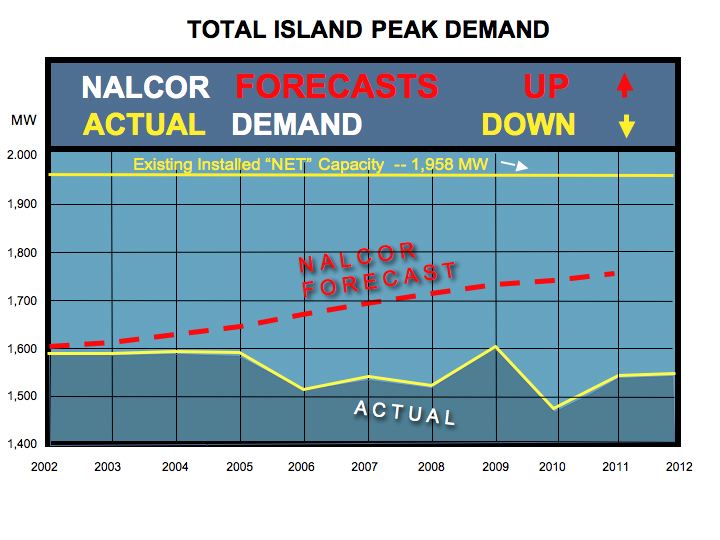

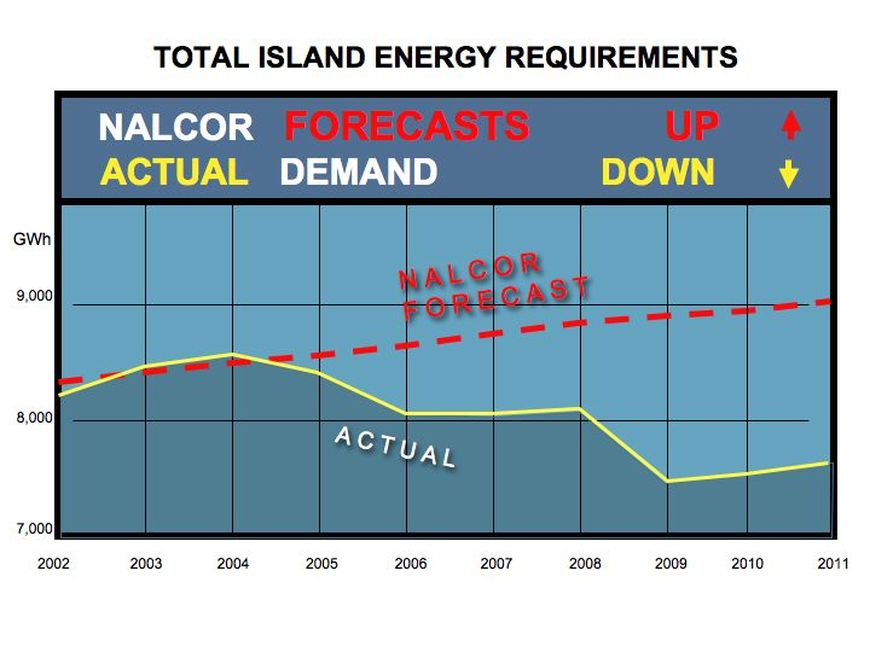

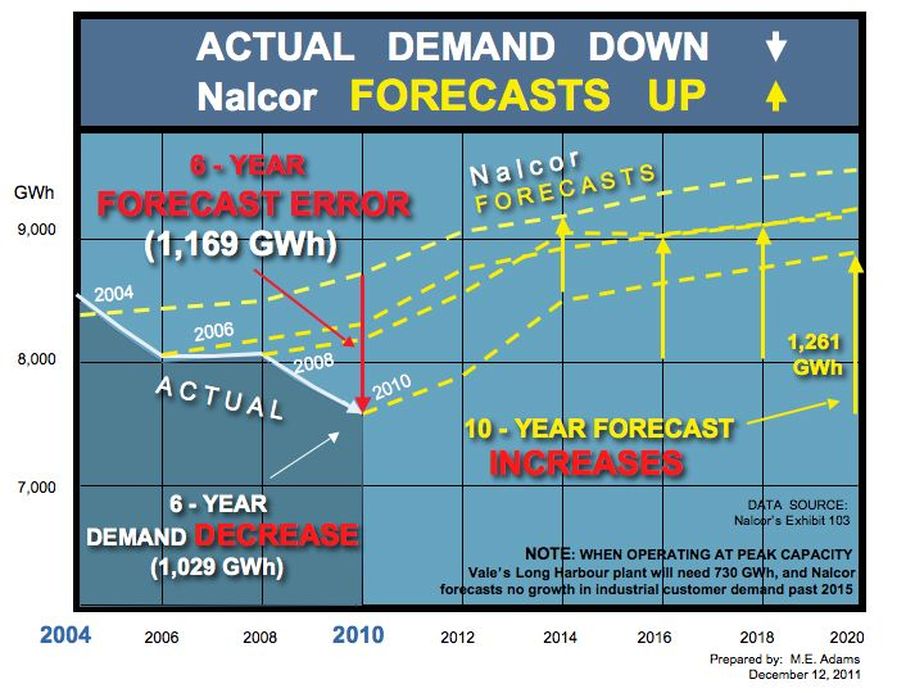

Information (received this week) from Nalcor shows that the actual rate of increase in peak demand in 2012 was more than 5 times less than Nalcor's 2010 (DG2) forecast (0.4% vs. 2.1%). For 2013, the actual rate of increase in peak demand was 1.3% vs. a forecast 1.9% increase (more than 30% less).

On average over the 2 years, the actual average rate of increase was almost 60% less than Nalcor's DG2 forecast.

Information (received this week) from Nalcor shows that the actual rate of increase in peak demand in 2012 was more than 5 times less than Nalcor's 2010 (DG2) forecast (0.4% vs. 2.1%). For 2013, the actual rate of increase in peak demand was 1.3% vs. a forecast 1.9% increase (more than 30% less).

On average over the 2 years, the actual average rate of increase was almost 60% less than Nalcor's DG2 forecast.

M I S L E A D I N G ?

D A T A P R E S E N T A T I O N

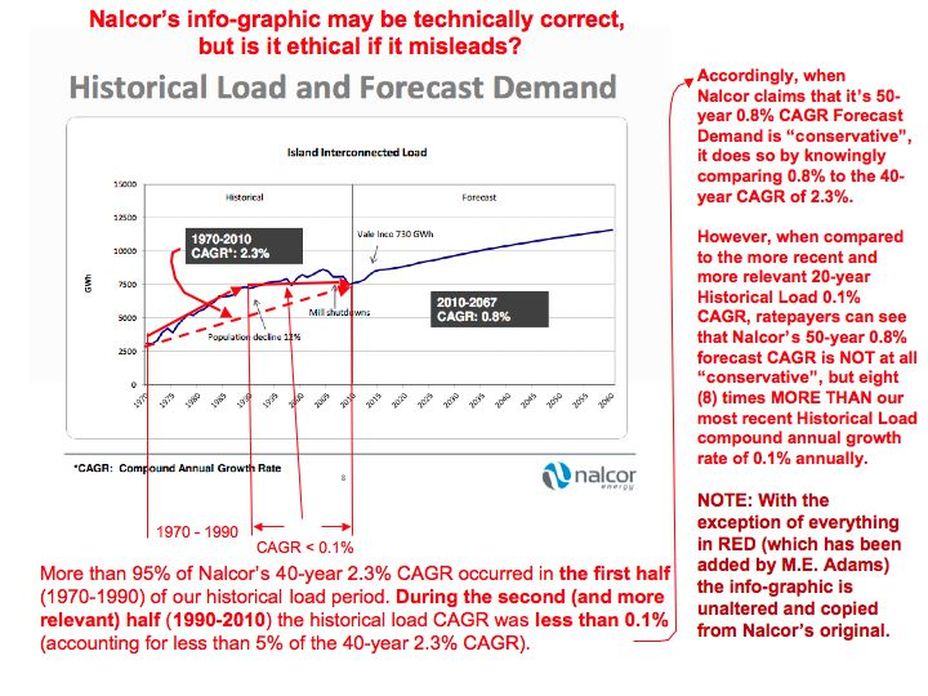

Nalcor had to reach way back 40 years in order to be able to say that the island's load growth has historically

been 2.3% annually. Only in that way could Nalcor say that its forecast demand of 0.8% annually was

"conservative".

Misleading? Ethical?

You decide

ISLAND RATEPAYERS DO NOT NEED HIGH COST MUSKRAT FALLS POWER, WHY THEN

IS IT BEING BUILT ?

( and why are low / middle income ratepayers paying for it ? )

Peter Jackson's column in today's (28 Nov. 2012) Telegram argues that energy analyst Tom Adams fails to recognize the difference between the island's industrial demand and the upward trend in island's household demand (see link).

http://www.thetelegram.com/Opinion/Columns/2012-11-28/article-3129195/Natural-gas%3A%E2%80%88viable-alternative-or-pipe-dream/1#Comments

My comments are below:

HERE ARE THE FACTS PETER:---- Between 1990 and 2008, while our number of homes increased by 19%, total residential energy consumption DECREASED BY 17%, and government targets a further 20% reduction by 2020........ Yet Nalcor forecasts and Muskrat Falls depends on, not only a total island 10% increase by 2020 but also on an average 0.8% annual compound increase until 2067.... Now while you seem to recognize the reduction we have had in industrial demand (and Nalcor forecasts no increase in that sector past 2015), if you look closely at the increase we have historically had in residential electricity demand, Nalcor is now a victim of its own success in that that increase has NOT BEEN due to an overall increase in residential energy demand, but solely due to electricity moving into and rapidly displacing the oil heating's share of the total and rapidly shrinking residential energy market......... At the historical rate that electricity has been displacing oil heat (displaced from 42% to 18% from 1990 - 2008, and likely down to less than 15% by now), the potential for further growth in residential electricity demand will be virtually non existent around year 2018 ---- shortly after Muskrat Falls comes on stream.......... Yet Muskrat Falls, in order to be viable, needs (must have) a 50 year increase in island demand ( not a 5 or 10 year increase) and that gentle incline that you speak of (0.8% COMPOUNDED ANNUALLY) just happens to be 800% HIGHER THAN our 20-year historical growth rate of 0.1% annually......... So, there is no increase in residential energy demand now, no evidence of increased residential electricity demand post the 2018-2020 period, no evidence of increased demand from the industrial sector, no outside sales (except at a loss), no sales to mining companies (except at a loss), and the evidence actually points to a likely reduction in residential electricity demand starting around 2018 (see www.vision2041.com, and link to the province's 2011 Energy Efficiency Plan and Climate Change Plans)..... Where then are the facts that support a 50-year (business case essential) increase in demand? There are none.

http://www.thetelegram.com/Opinion/Columns/2012-11-28/article-3129195/Natural-gas%3A%E2%80%88viable-alternative-or-pipe-dream/1#Comments

My comments are below:

HERE ARE THE FACTS PETER:---- Between 1990 and 2008, while our number of homes increased by 19%, total residential energy consumption DECREASED BY 17%, and government targets a further 20% reduction by 2020........ Yet Nalcor forecasts and Muskrat Falls depends on, not only a total island 10% increase by 2020 but also on an average 0.8% annual compound increase until 2067.... Now while you seem to recognize the reduction we have had in industrial demand (and Nalcor forecasts no increase in that sector past 2015), if you look closely at the increase we have historically had in residential electricity demand, Nalcor is now a victim of its own success in that that increase has NOT BEEN due to an overall increase in residential energy demand, but solely due to electricity moving into and rapidly displacing the oil heating's share of the total and rapidly shrinking residential energy market......... At the historical rate that electricity has been displacing oil heat (displaced from 42% to 18% from 1990 - 2008, and likely down to less than 15% by now), the potential for further growth in residential electricity demand will be virtually non existent around year 2018 ---- shortly after Muskrat Falls comes on stream.......... Yet Muskrat Falls, in order to be viable, needs (must have) a 50 year increase in island demand ( not a 5 or 10 year increase) and that gentle incline that you speak of (0.8% COMPOUNDED ANNUALLY) just happens to be 800% HIGHER THAN our 20-year historical growth rate of 0.1% annually......... So, there is no increase in residential energy demand now, no evidence of increased residential electricity demand post the 2018-2020 period, no evidence of increased demand from the industrial sector, no outside sales (except at a loss), no sales to mining companies (except at a loss), and the evidence actually points to a likely reduction in residential electricity demand starting around 2018 (see www.vision2041.com, and link to the province's 2011 Energy Efficiency Plan and Climate Change Plans)..... Where then are the facts that support a 50-year (business case essential) increase in demand? There are none.

CLICK IMAGE TO ENLARGE

TOTAL SYSTEM LOAD

NOTE:- over the entire 18 year period (1994 to 2012), electricity consumption

went down more often than it went up (10 of the 18 years), so that by 2012 the

island's electricity consumption was still below 1993 levels (red line below)

TOTAL SYSTEM LOAD

NOTE:- over the entire 18 year period (1994 to 2012), electricity consumption

went down more often than it went up (10 of the 18 years), so that by 2012 the

island's electricity consumption was still below 1993 levels (red line below)

|

|

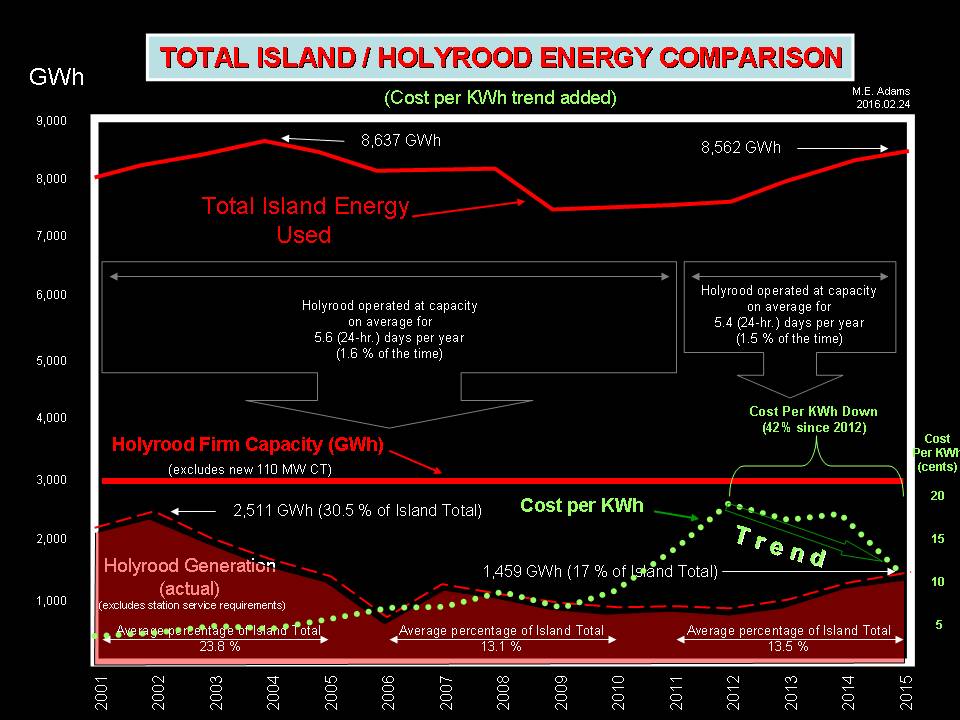

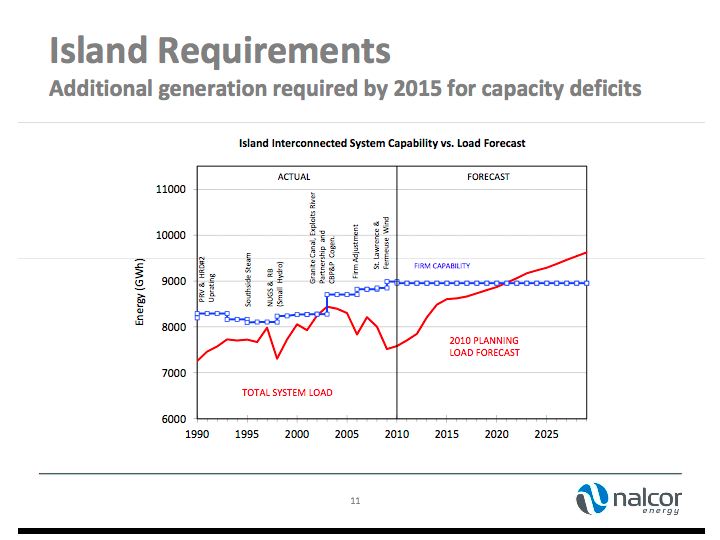

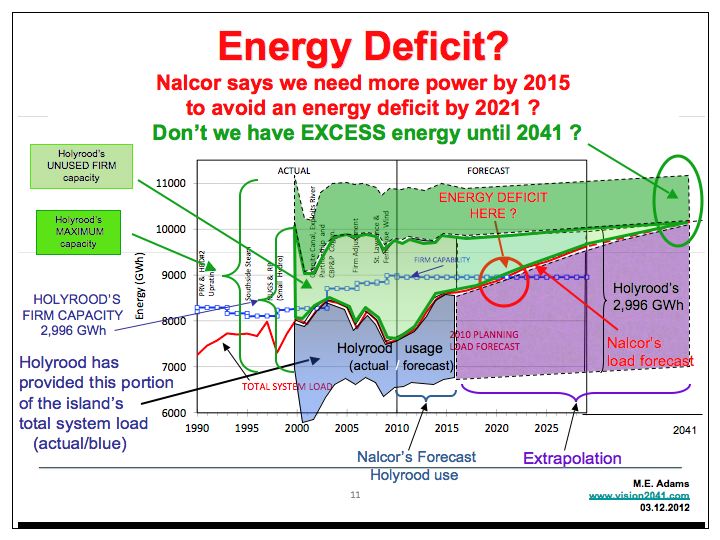

NOTE: Holyrood's share of the island's total energy needs ranged from a low of 11.5% in 2010 to a high of 29% in 2002. While early on, Nalcor forecast that Vale's 730 GWh of additional demand would be met by Holyrood, however, last year Nalcor spilled 694 GWh of EXCESS water equivalent energy from the island's hydro sites and gave evidence before the PUB that it would continue to spill EXCESS energy until Vale comes on stream to use up the island's already EXCESS energy. So the post-2016 forecast increase use of Holyrood may be considerably less than shown In purple (above), meaning that any energy deficit may not occur until well beyond 2041.

Nalcor is already forecasting that for each of the next 5 years the province will need from Holyrood about 5% less than what it was predicting just 1 year ago. Some wind, efficiency improvements and perhaps some small hydro can virtually eliminate our already very limited use of Holyrood. THERE IS NO PENDING 'ENERGY DEFICIT' -- SEE info-graphic (TOP, RIGHT). NOTE: In 2012, Holyrood provided only 10.8% (856 GWh) of the island's total energy needs (lower than the year 2010 low of 11.5%) |

DO WE NEED THE POWER?

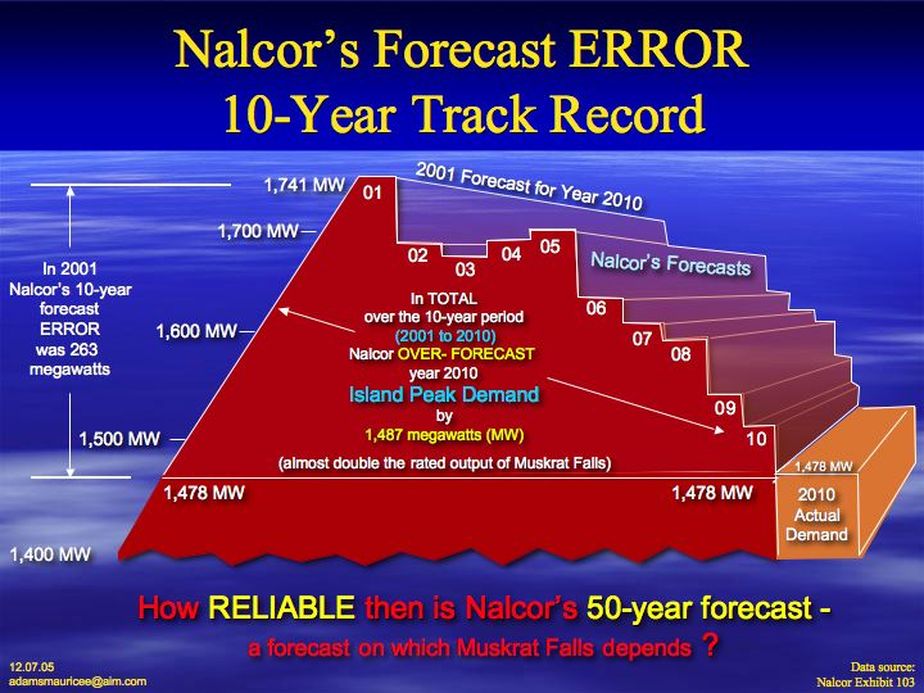

Nalcor's 10-year Forecast Accuracy

Track Record

|

TOTAL ISLAND PEAK DEMAND* Existing installed "NET" capacity 1,958 megawatts (MW) |

TOTAL ISLAND ENERGY REQUIREMENT* gigawatthours (GWh) |

|

2001 FORECAST (MW) 1,602 1,611 1,632 1,652 1,673 1,696 1,719 1,735 1,741 1,756 1,771 1,786 1,802 1,818 1,836 |

ACTUAL (MW) 1,592 1,595 1,598 1,595 1,517 1,540 1,520 1,601 1,478 1,525 1,531** 1.640** 1,687 1,705 1,673 **Nalcor's 2010 peak demand forecast for year 2012 was 1,571 MW and for year 2013 was 1,601 MW |

YEAR 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 |

2001 FORECAST (GWh) 8,316 8,384 8,479 8,560 8,639 8,734 8,831 8,894 8,929 9,018 9,102 9,183 9,269 9,355 9,453 |

ACTUAL (GWh) 8,224 8,446 8,637 8,496 8,088 8,082 8,103 7,500 7,608 7,743 7,913 8,054 8,193 8,426 8,341 |

|

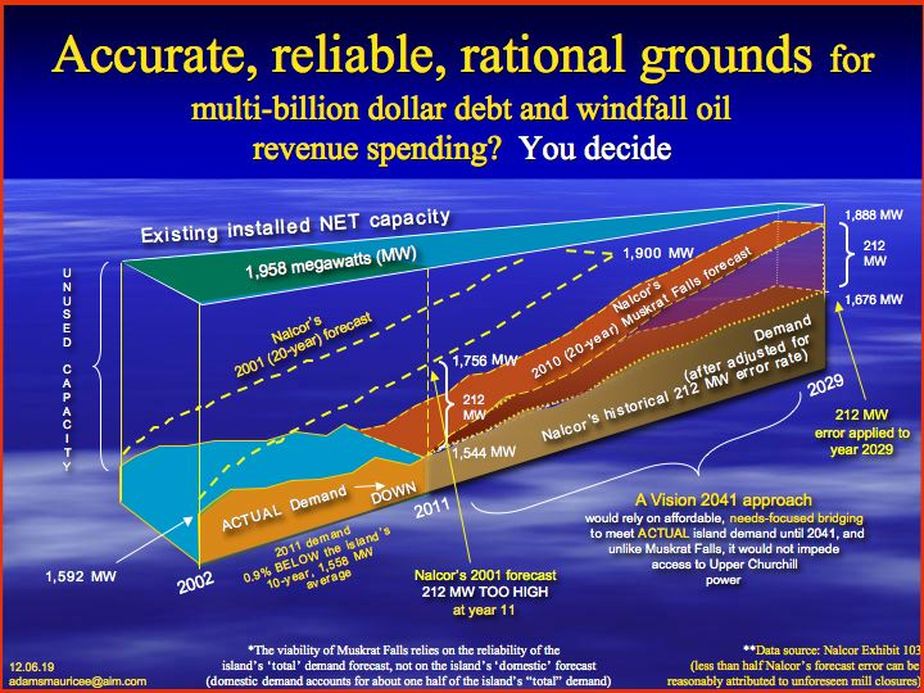

Nalcor's demand forecast error (10-year track record) was 231 MW TOO HIGH -- just 10 years into the future, see above (1,756 minus 1,525 MW). MHI reported that Nalcor's long, 50-year forecast period "magnified risk", and applying Nalcor's proven 10-year error rate to Nalcor's 50-year forecast period would result in over-forecasting demand by 1,060 MW by 2067 -- more than double the NET capacity of Holyrood.

Keep in mind that the very viability of Muskrat Falls depends, not on the credibility and accuracy of Nalcor's 10-year, but on the credibility and accuracy of Nalcor's "50-year" forecast. |

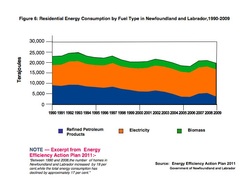

Government and Nalcor say we need more power due to an increase in RESIDENTIAL demand.

Government's 2011 Energy Efficiency Action Plan and Climate Change Action Plan both state firmly that between 1990 and 2008, while the number of homes increased by 19%, total energy consumption DECREASED BY 17%, and government targets a further 20% reduction by 2020 (yet Nalcor forecasts and for Muskrat Falls to be viable it depends on, not only a 10% increase by 2020 but also an average 0.8% annual compound increase FOR 50 YEARS --- until 2067) |

NOTE: Peak demand has been more than 400 MW BELOW the island's

existing installed "NET" capacity of 1,958 MW for almost every year since 2005

*Data source: Nalcor's Exhibit 103 and Leadership blog.

http://www.pub.nf.ca/applications/MuskratFalls2011/nalcordocs.htm

Government would have you "BELIEVE" that we need the power.

What if you had 'believed' Nalcor's past 10-year FORECAST (see above)?

But the viability of Muskrat Falls depends, not on a 10-year, but on a 50-year forecast.

By 2011, Nalcor's 10-year (2001) forecast was already more than 200 megawatts (MW) HIGHER THAN what the island actually needed --- and more than 400 MW BELOW our already existing installed NET capacity. At that error rate, Nalcor's 50-year forecast will exceed the island's actual power needs by more than 65%.

What will that do for the viability of Muskrat Falls (and your power bill)? With Muskrat Falls, the less power we actually use, the higher our rates will have to go (Nalcor will still need your money to pay off the Muskrat Falls debt).

http://www.pub.nf.ca/applications/MuskratFalls2011/nalcordocs.htm

Government would have you "BELIEVE" that we need the power.

What if you had 'believed' Nalcor's past 10-year FORECAST (see above)?

But the viability of Muskrat Falls depends, not on a 10-year, but on a 50-year forecast.

By 2011, Nalcor's 10-year (2001) forecast was already more than 200 megawatts (MW) HIGHER THAN what the island actually needed --- and more than 400 MW BELOW our already existing installed NET capacity. At that error rate, Nalcor's 50-year forecast will exceed the island's actual power needs by more than 65%.

What will that do for the viability of Muskrat Falls (and your power bill)? With Muskrat Falls, the less power we actually use, the higher our rates will have to go (Nalcor will still need your money to pay off the Muskrat Falls debt).

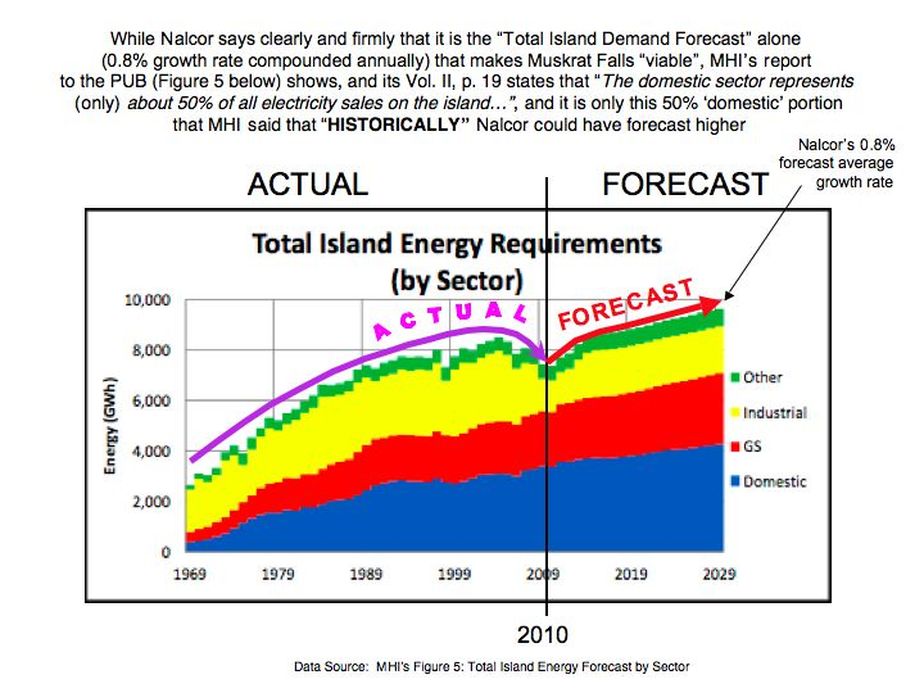

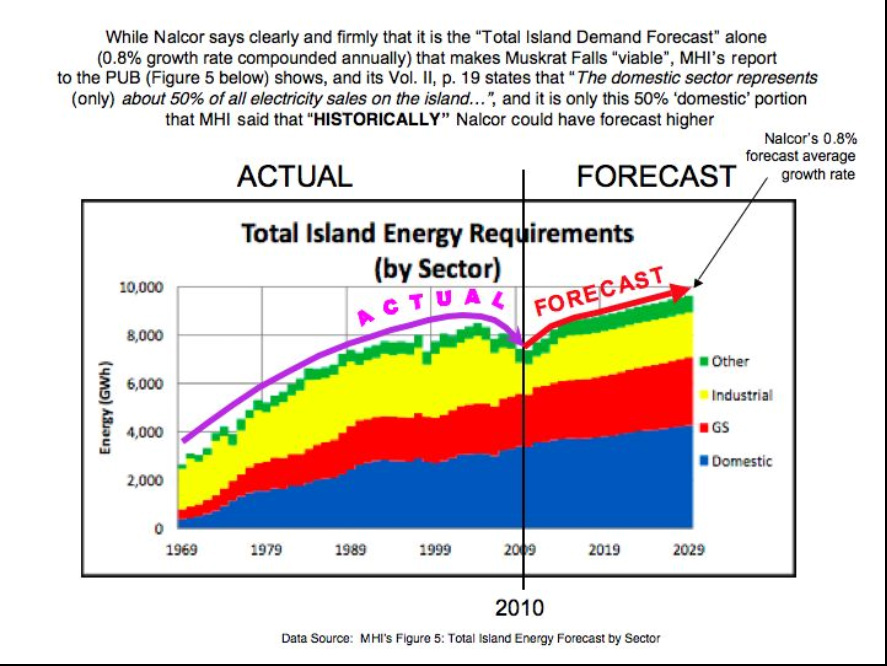

When government and MHI say that Nalcor could have forecast even slightly higher demand, that comment is being misused by government.

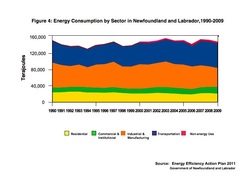

MHI directed that comment, not at the island's "total" demand (the demand forecast on which Muskrat Falls depends and needs), but at the island's 'domestic' demand only --- which you can see below, makes up only 50% of the island's total demand.

Furthermore, MHI confirmed that Nalcor's forecast methodology DOES NOT USE the industry's "best practice".

If it did so, the island's 'de-industrialization', with electricity replacing the oil industry's portion of the home heating market for its actual and forecast increase in residential electricity growth, combined with the fact that there is virtually no heating demand in summertime, an accurate (end-use) industry "best practice" forecast would have shown a much lower and diminishing "total island" energy forecast (some proof of which can already be detected in the above referenced 10-year energy "actuals").

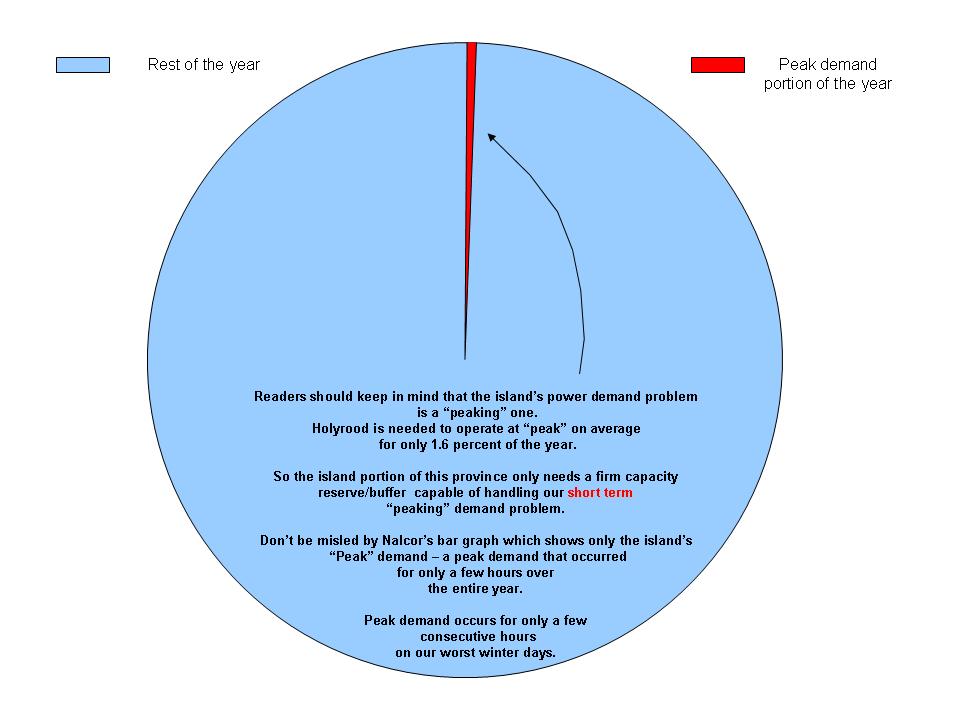

You will note that while 'peak demand' has remained flat (down very slightly), energy usage has clearly gone down significantly. Additional actual evidence can also be seen in the dramatically reduced reliance on Holyrood for energy production (while its 'net' capacity is 3,000 GWh annually, in recent years Holyrood has been needed to produce only around 800 GWh of energy annually, and last year Holyrood did not operate AT CAPACITY at all --- not even in winter).

Industry "best practice" (end-use) forecast modeling therefore would have shown and would have highlighted the above-referenced errors in Nalcor's forecast and would have demonstrated, even more clearly, that "we do not need the power".

MHI directed that comment, not at the island's "total" demand (the demand forecast on which Muskrat Falls depends and needs), but at the island's 'domestic' demand only --- which you can see below, makes up only 50% of the island's total demand.

Furthermore, MHI confirmed that Nalcor's forecast methodology DOES NOT USE the industry's "best practice".

If it did so, the island's 'de-industrialization', with electricity replacing the oil industry's portion of the home heating market for its actual and forecast increase in residential electricity growth, combined with the fact that there is virtually no heating demand in summertime, an accurate (end-use) industry "best practice" forecast would have shown a much lower and diminishing "total island" energy forecast (some proof of which can already be detected in the above referenced 10-year energy "actuals").

You will note that while 'peak demand' has remained flat (down very slightly), energy usage has clearly gone down significantly. Additional actual evidence can also be seen in the dramatically reduced reliance on Holyrood for energy production (while its 'net' capacity is 3,000 GWh annually, in recent years Holyrood has been needed to produce only around 800 GWh of energy annually, and last year Holyrood did not operate AT CAPACITY at all --- not even in winter).

Industry "best practice" (end-use) forecast modeling therefore would have shown and would have highlighted the above-referenced errors in Nalcor's forecast and would have demonstrated, even more clearly, that "we do not need the power".

MUSKRAT FALLS --- "DO WE NEED THE POWER?"

There is no rational, evidence-based grounds to support the view that the island needs the power (and now an Economic Analysis done by Natural Resources Canada (NRC) says that provided growth in demand is low, Muskrat Falls is not the lowest cost power for the island).

What constitutes "low" demand?

Nalcor argues that since the island has averaged a growth rate of 2.3% annually, its 50-year growth forecast of only 0.8% annually is 'conservative'. Compared to 2.3% then, isn't 0.8% 'low' demand?

Excerpt from NRC report "the Project was found to be the lowest cost option except under a low demand growth scenario in which case either Churchill Falls recall power or some combination of enhanced wind power, small hydro, CDM and fossil-fired power would be a lower cost option."

While MHI said that "historically" a portion of Nalcor's forecast accuracy (the portion known as 'domestic' demand) was within the industry standard of + or - 1% annually, MHI also points out that on average domestic demand was nevertheless 1% annually below the industry standard and that therefore on average for each year of the 10-year HISTORICAL period that was reviewed for accuracy, Nalcor could have forecast 1% higher.

So, in its proper context, MHI's comment about needing even more power than what was forecast, was directed at 'domestic' demand only, and it was primarily directed at the historical forecasts that Nalcor did during the 10-year historical review period (2001-2010) ---- MHI pointed out clearly that Nalcor DID NOT USE BEST PRACTICES TO FORECAST OUR FUTURE ENERGY NEEDS.

Furthermore, you can see from MHI's graph below that 'domestic' demand makes up only a portion (50%) of the island's total demand, while the viability of Muskrat Falls depends on the forecast accuracy and reliability of the island's "TOTAL" demand, and it is the total demand which HISTORICALLY Nalcor significantly and consistently over-forecast over the entire 10-year review period.

There is no rational, evidence-based grounds to support the view that the island needs the power (and now an Economic Analysis done by Natural Resources Canada (NRC) says that provided growth in demand is low, Muskrat Falls is not the lowest cost power for the island).

What constitutes "low" demand?

Nalcor argues that since the island has averaged a growth rate of 2.3% annually, its 50-year growth forecast of only 0.8% annually is 'conservative'. Compared to 2.3% then, isn't 0.8% 'low' demand?

Excerpt from NRC report "the Project was found to be the lowest cost option except under a low demand growth scenario in which case either Churchill Falls recall power or some combination of enhanced wind power, small hydro, CDM and fossil-fired power would be a lower cost option."

While MHI said that "historically" a portion of Nalcor's forecast accuracy (the portion known as 'domestic' demand) was within the industry standard of + or - 1% annually, MHI also points out that on average domestic demand was nevertheless 1% annually below the industry standard and that therefore on average for each year of the 10-year HISTORICAL period that was reviewed for accuracy, Nalcor could have forecast 1% higher.

So, in its proper context, MHI's comment about needing even more power than what was forecast, was directed at 'domestic' demand only, and it was primarily directed at the historical forecasts that Nalcor did during the 10-year historical review period (2001-2010) ---- MHI pointed out clearly that Nalcor DID NOT USE BEST PRACTICES TO FORECAST OUR FUTURE ENERGY NEEDS.

Furthermore, you can see from MHI's graph below that 'domestic' demand makes up only a portion (50%) of the island's total demand, while the viability of Muskrat Falls depends on the forecast accuracy and reliability of the island's "TOTAL" demand, and it is the total demand which HISTORICALLY Nalcor significantly and consistently over-forecast over the entire 10-year review period.

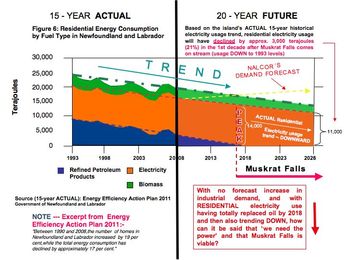

If one looks closely at the "ACTUAL" portion of the above graph, it can be seen that in the most recent 20-year period (1990-2010) "total" demand has been virtually flat, and over the last 6-year period demand has been DOWN about 2.5% per year --- and it is the "total" (not merely the "domestic") increase in demand that Muskrat Falls needs --- if it is to be viable.

Furthermore, MHI makes it clear, that Nalcor's forecasts can be depended on only to the extent that its assumptions underlying its forecast methodology are sound. It is important to note therefore that Nalcor's "domestic" forecast is based (and depends) on its assumption that the demand for electric heat will continue to increase.

MHI report, Vol. II, p. 19 states that "Virtually all growth in the domestic average use model is attributable to electric heat...". So if that model/assumption cannot be supported for Nalcor's Muskrat Falls'-required 50-year business case scenario, then the so-called 'viability' of Muskrat Falls is not supported by the evidence and the project then fails to meet any reasonable business case credibility test. Please READ ON

Please review the 'RESIDENTIAL DEMAND DOWN' section below, and you will see that Nalcor's assumption about increased demand for electric heat is deeply flawed.

Increased electricity use has been primarily (almost exclusively) --- not due to an increase in total domestic/ residential energy demand, but due almost totally to electricity moving into and virtually eliminating the oil industry's share of the domestic/residential energy market. And by the time that Muskrat Falls comes on stream, Nalcor's potential for further electricity growth in the domestic/residential energy market (as you can see from the graph below) will be virtually --- non-existent.

Accordingly, the argument for 50 year, increased 'residential' demand, is deeply flawed and lacks sound, evidence-based grounds for concluding that the island needs more power.

Government's position therefore --- that the experts (MHI) conclude that the island needs even more power than Nalcor has forecast, is not supported by a correct understanding and interpretation of what MHI actually said.

In fact, the evidence actually confirms a significant reduction (17%) in residential energy use since 1990 and points toward the virtual elimination of the potential for increased electricity use after 2018 (about when Muskrat Falls comes on stream).

See --- "Looking for proof of increasing electrical demand" (The Weekend Telegram, October 6th, 2012) http://www.vision2041.com/articlesletters.html READ ON

It is Nalcor's "total" island demand forecast on which the viability of Muskrat Falls is predicated.

I will later address Nalcor's consistent and significant OVER-FORECAST of the island's total demand (and you will see that MHI all but whitewashes Nalcor's MAJOR total demand forecasting accuracy ERROR). In effect, MHI says that if Nalcor had "accurately predicted" the timing and magnitude of a major reduction in the island's industrial demand, then its "total island energy requirements forecast would have been exceptionally accurate".

Isn't that like saying --- "My forecasting would have been "exceptionally accurate", if only I could have "accurately predicted" (that is, if only I could have "accurately forecast") my future forecast requirements? In short --- utter nonsense --- a tautological argument:

DEFINITION:- "A rhetorical tautology can...be defined as a series of statements that form an argument, whereby the statements are constructed in such a way that the truth of the proposition is guaranteed or that, by defining a dissimilar or synonymous term in terms of another self-referentially, the truth of the proposition or explanation cannot be disputed. Consequently, the statement conveys no useful information regardless of its length or complexity making it unfalsifiable. It is a way of formulating a description such that it masquerades as an explanation when the real reason for the phenomena cannot be independently derived"

Actual quote from MHI report, Vol. II, p. 28 ---- "Table 13 shows that the total island energy requirements forecast would have been exceptionally accurate, if the timing and magnitude (emphasis added) of mill closures were accurately predicted in the previous load forecasts."

Well isn't that just a "peachy", insightful statement?

The very act of 'accurate forecasting', involves 'predicting' the "timing" and the "magnitude" of future events.

So if Nalcor were grossly in error in predicting (forecasting) the 'timing' and the 'magnitude' of future industrial demand, and therefore grossly in error in forecasting the "total" island demand (on which the very viability of Muskrat Falls depends), then how meaningful is it to say that "if the timing and magnitude...were accurately predicted", then "the total island energy requirements forecast would have been exceptionally accurate"?

Isn't that just a way of "formulating a description such that it masquerades as an explanation..."?

Furthermore, (and perhaps more important and more relevant than MHI's tautology) it is important to note that the first mill did not close until 2006 (in the 6th year of Nalcor's historical 10-year forecast period -- the period that was reviewed for accuracy by MHI. Nevertheless, Nalcor's gross forecasting error (over-forecasting) was consistently much TOO HIGH (ranging from 500% too high in 2001 to 1000% too high in 2005 --- years BEFORE the closure of any paper mills) --- ERROR RATES that range from 5 to 10 times the industry standard of + or - 1 per cent annually.

In short, MHI's 'excuses' for Nalcor's forecasting error does nothing to explain away Nalcor's consistent and significant OVER-FORECASTING ACCURACY ERROR for the first half of its 10-year review period.

Accordingly, MHI's convoluted excuse cannot therefore be used to explain away Nalcor's 10-year "total" island forecast error track record, and it is the total island forecast on which the very viability of Muskrat Falls depends.

Click on image to enlarge

RESIDENTIAL DEMAND DOWN

Government and Nalcor both argue that Muskrat Falls is viable based solely on a 50-year forecast increase in island demand (Nalcor forecasts an average 0.8% increase compounded annually).

In its 2011 written submission to the Public Utilities Board, Nalcor states clearly that there is no forecast increase in demand from the island's industrial sector after year 2015.

Accordingly, government and Nalcor both claim that the island needs the power due primarily to a forecast increase in electricity use by the island's residential sector, caused in large part by the increase in the number of new and larger homes, the use of electric heat and the use of home appliances.

Please review carefully the info-graphics (upper left) and you will see that based on government's own 15-year historical data, shortly after Muskrat Falls comes on stream in 2017, residential electricity use will go DOWN, not up (what will that do to electricity rates? --- Nalcor's multi-billion dollar debt will still have to be paid, and with electricity use down, rates will have to go UP -- WAY UP.)

The info-graphic shows that by around 2018 electricity will have totally replaced the oil industry's home energy market share (residential electricity use has, in the past, INCREASED NOT DUE TO MORE AND LARGER HOMES, but instead, due to electricity moving into and reducing the oil industry's market share).

Nalcor has effectively reduced the oil industry's residential energy market share from 42% in 1990 to 18% in 2008 (see link to the province's Energy Efficiency Action Plan 2011 below).

At the current rate, by 2018 electricity will have totally eliminated the oil industry's residential energy market share. In addition, the total residential energy market (the total size of the residential energy pie, so to speak) from 1990 to 2008 also decreased by 17%.

Overall, residential energy use has on average trended consistently DOWNWARD since 1990. Nevertheless, for Muskrat Falls to be viable, the project needs (must have), must show, not a 5 or 10 year increase, but a 50-year electricity demand increase of 0.8% compounded annually.

Where then are the evidence-based grounds for a 50-year increase in residential energy and electricity use? Where are the grounds for any continuing residential energy and electricity increase past year 2018 (not alone for 50 years)?

Where are the evidence-based grounds on which government can rationally claim that the island 'needs the power', and that therefore --- "Muskrat Falls is viable"?

There are none.

Without rational, evidence-based grounds for 50 years of increased island demand, how can it be said that Muskrat Falls is viable?

It cannot.

www.exec.gov.nl.ca/exec/cceeet/publications/energy_efficiency.pdf

---------------------------------------------------------------------------------------------------------------------------------------------------------------

NEWS

Excerpt for Globe and Mail, 01 October 2012 (“Energy firms guaranteed revenue in sweetheart deals with Ontario”)

"Alberta energy giant TransCanada Corp is guaranteed revenue of $3.3-billion over the next two decades – no matter how much power it produces – in return for building the province’s third largest natural gas-fired plant in Eastern Ontario, the documents show." http://www.theglobeandmail.com/news/national/energy-firms-guaranteed-revenue-in-sweetheart-deals-with-ontario/article4578751/

NOTE: With Muskrat Falls, island ratepayers will have $35 billion guaranteed to come out of their, their children and grandchildren's pockets for a guaranteed 50 years -----EVEN THOUGH WE DO NOT NEED THE POWER (Read on, and see other vision2041 web pages for $35 billion info-graphic)

In its 2011 written submission to the Public Utilities Board, Nalcor states clearly that there is no forecast increase in demand from the island's industrial sector after year 2015.

Accordingly, government and Nalcor both claim that the island needs the power due primarily to a forecast increase in electricity use by the island's residential sector, caused in large part by the increase in the number of new and larger homes, the use of electric heat and the use of home appliances.

Please review carefully the info-graphics (upper left) and you will see that based on government's own 15-year historical data, shortly after Muskrat Falls comes on stream in 2017, residential electricity use will go DOWN, not up (what will that do to electricity rates? --- Nalcor's multi-billion dollar debt will still have to be paid, and with electricity use down, rates will have to go UP -- WAY UP.)

The info-graphic shows that by around 2018 electricity will have totally replaced the oil industry's home energy market share (residential electricity use has, in the past, INCREASED NOT DUE TO MORE AND LARGER HOMES, but instead, due to electricity moving into and reducing the oil industry's market share).

Nalcor has effectively reduced the oil industry's residential energy market share from 42% in 1990 to 18% in 2008 (see link to the province's Energy Efficiency Action Plan 2011 below).

At the current rate, by 2018 electricity will have totally eliminated the oil industry's residential energy market share. In addition, the total residential energy market (the total size of the residential energy pie, so to speak) from 1990 to 2008 also decreased by 17%.

Overall, residential energy use has on average trended consistently DOWNWARD since 1990. Nevertheless, for Muskrat Falls to be viable, the project needs (must have), must show, not a 5 or 10 year increase, but a 50-year electricity demand increase of 0.8% compounded annually.

Where then are the evidence-based grounds for a 50-year increase in residential energy and electricity use? Where are the grounds for any continuing residential energy and electricity increase past year 2018 (not alone for 50 years)?

Where are the evidence-based grounds on which government can rationally claim that the island 'needs the power', and that therefore --- "Muskrat Falls is viable"?

There are none.

Without rational, evidence-based grounds for 50 years of increased island demand, how can it be said that Muskrat Falls is viable?

It cannot.

www.exec.gov.nl.ca/exec/cceeet/publications/energy_efficiency.pdf

---------------------------------------------------------------------------------------------------------------------------------------------------------------

NEWS

Excerpt for Globe and Mail, 01 October 2012 (“Energy firms guaranteed revenue in sweetheart deals with Ontario”)

"Alberta energy giant TransCanada Corp is guaranteed revenue of $3.3-billion over the next two decades – no matter how much power it produces – in return for building the province’s third largest natural gas-fired plant in Eastern Ontario, the documents show." http://www.theglobeandmail.com/news/national/energy-firms-guaranteed-revenue-in-sweetheart-deals-with-ontario/article4578751/

NOTE: With Muskrat Falls, island ratepayers will have $35 billion guaranteed to come out of their, their children and grandchildren's pockets for a guaranteed 50 years -----EVEN THOUGH WE DO NOT NEED THE POWER (Read on, and see other vision2041 web pages for $35 billion info-graphic)

|

WHERE IS GOVERNMENT'S PLANNED 2011 LOWER COST, (ALTERNATIVE OPTION) FIXED-LINK FEASIBILITY STUDY ? Government's own 2005 Pre-feasibility Study concluded that a fixed link (tunnel) across the Strait of Belle Isle could carry both people and power and cost ABOUT $2 BILLION LESS THAN a new dam/generation plant (only $1.2 billion in 2004 dollars, $1.7 including financing and interest during construction). It would also save almost $400 million on the cost of the power line. In 2011, as a follow-up to the pre-feasibility study, government said it would do a full-fledged "Feasibility Study" into the viability of a 'fixed link". WHERE IS IT? With NEAR-ZERO COST Upper Churchill recall power and (IF NEEDED) a 5 cent/KWh power purchase from Hydro Quebec, combined with the socio-economic intra/interprovincial benefit of a fixed link, on every level (economic, social, fiscal, revenue generating, province/nation-building, strategic and political LEADERSHIP level), this ALTERNATIVE, LOWER COST, FIXED-LINK OPTION is deserving of full and careful consideration. READ ON: Also, letter to the editor, "Marine Atlantic is no link" (The Telegram), 29 August 2012: Quote: "At a time when Newfoundland and Labrador expects and demands a modern and reliable transportation service, let's build "The Strunnel" now, so that once and for all we can have our own fixed link and put us on an equal footing with the rest of Canada (emphasis added)" -- Dave Rudofsky, St. John's T H E F A C T S

THERE IS NO URGENCY (see also, RATES and HOLYROOD pages) ------------------------------------------------------------------------------------------------------

|

DOMESTIC RESIDENTIAL ENERGY CONSUMPTION DOWN****

Nalcor says that the very viability of Muskrat Falls depends on its forecast increase in the island's electricity demand (and Nalcor forecasts an average increase of 0.8% compounded annually for the next 50 years).

However, look closely at the province's residential energy consumption (above, yellow). Note the trend.

Furthermore, while MHI says that Nalcor could have forecast even higher domestic demand, Nalcor says that demand is UP (?) due to an increase in the number of new homes and households using electricity.

However, look at government's own graph at left -- and read the "NOTE". Note also, that while electrical energy has captured a larger share of the island's total EXISTING (AND DIMINISHING) energy market, it has done so at the expense of oil's historical market share. Note also that not only has the potential for further inroads into oil's historical market share been cut in half (and therefore potential growth in electrical energy use from that source is now significantly reduced, AND LIMITED), but perhaps more importantly, overall residential energy use has continued on average to trend significantly DOWNWARD (not upward) over the entire 20-year period. FURTHERMORE, government's own Energy Efficiency Action Plan 2011 (from which the above graphs are taken) is targeting a further 20% REDUCTION in consumption by 2020 --- while Nalcor (in its justification for Muskrat Falls), needs ("AND FORECASTS") a significant INCREASE by year 2020 -- AND BEYOND -- right up to year 2067. But, as can be seen from government's own graph, at the rate that electricity is replacing oil's market share (and given that total consumption is decreasing), within 20 years (by 2029 or perhaps even earlier) the potential for further increasing electrical energy market share by replacing oil will have been exhausted. Yet, for Muskrat Falls to be viable, it needs (MUST HAVE) increasing island demand (and thereby a forecast revenue source) right through UNTIL 2067 --- even though total island energy consumption is decreasing and the potential for electricity to increase market share by replacing oil will be non-existent by about 2029. How then, can Nalcor rationally conclude (as Minister Kennedy says) that "we need the power"? If we do not need (and therefore there is no significant REVENUE GENERATING market for) Muskrat Falls power, how then is Muskrat Falls viable? Also, during the Public Utilities Board review of Nalcor's proposed Muskrat Falls project, Nalcor advised that NO INCREASE in industrial demand is forecast PAST year 2015. NL government's Energy Efficiency Action Plan 2011 can be viewed at www.exec.gov.nl.ca/exec/cceeet/publications/energy_efficiency.pdf 2012.09.02 _____________________________________________________________ NEWS ALERT

August 23, 2012 U.S presidential hopeful Mitt Romney's Energy Plan calls for the U.S to be "energy independent" by 2020. What will that do to Nalcor's expectation of revenue from outside sales of Muskrat Falls power? What will it do for the price that Quebec Hydro will get for its massive amount of surplus hydro power (and the potential for NL therefore to access that cheap Upper Churchill power from Hydro Quebec and which will therefore be available to bridge our island needs until 2041)? Also, Hydro Quebec to get Muskrat Falls energy (see this link to article) http://bondpapers.blogspot.ca/2012/08/hydro-quebec-to-get-muskrat-falls.html ----------------------------------------------------------------------------------------------------- And, do Labrador's mining industry need power? Here are excerpts from a 20 Aug., 2012 Telegram article:

"When Australia’s BHP Billiton, the world’s largest mining company, backed off on $68 billion in investment plans last week and said it won’t approve any new projects. Australia’s natural resources minister, Martin Ferguson, declared that the commodities boom was “over”, before deciding he really didn’t mean that at all and “clarified” his statement, sort of. “Anyone with half a brain knows today’s record commodity prices are over,” he said. “The boom in commodity prices is over. No one can deny it. “Just think about it, coking coal a short time ago was $320 a tonne, it’s now $220 a tonne; iron ore was $180 a tonne, it’s now $105; thermal coal was $220 a tonne, it’s now $80 a tonne. It was great for a short period of time, I think it will be a long time before we see those record commodity prices again." http://fullcomment.nationalpost.com/2012/08/30/kelly-mcparland-australias-economy-has-a-warning-for-canada/ --------------------------------------------------------------------------------------------- Excerpt from the Globe and Mail, August 9th, 2012: "Britain's economy has lurched to a halt, France is heading back into recession and industrial powerhouse Germany is slowing noticeably,..." Britain -------- "Flirting with recession" Germany ---- "Slowing" France ------- "Likely in recession" Italy ----------- "Full-blown recession" 16 October 2012 (G & M): Greece ------- Unemployment at a record 25.1 per cent Spain --------- Unemployment at 24.6 per cent And the Bank of England says: "no growth at all this year (and)... Britain is facing up to three years of economic weakness." So where do you think the demand for oil (and iron ore) is headed? |

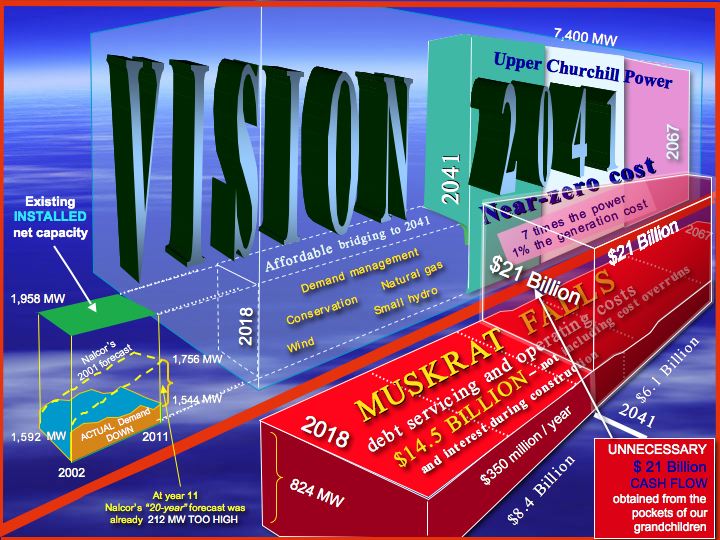

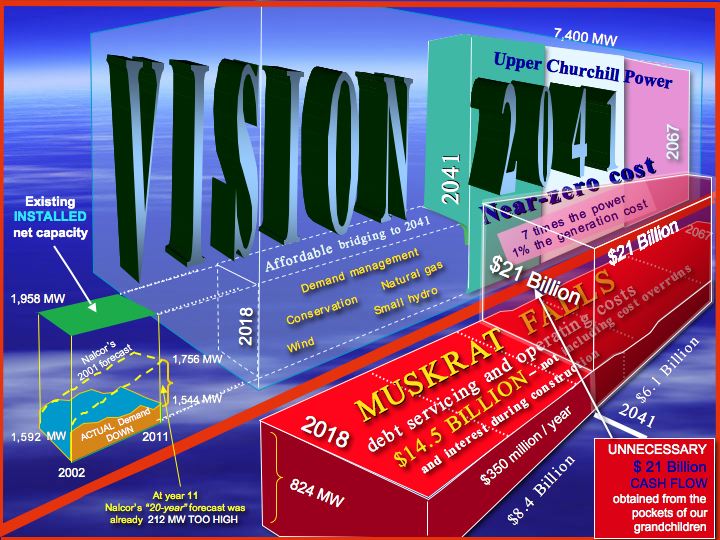

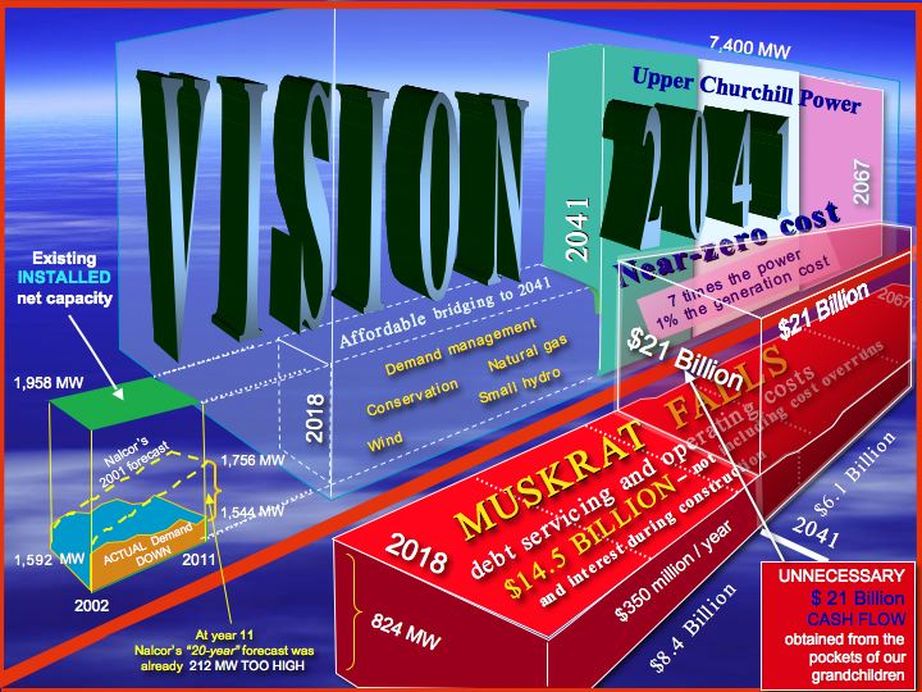

Nalcor makes what it refers to as a "good business case" for the Muskrat Falls project by showing, in part, the above-noted $21 billion cash flow after 2041 (a cash flow that can be obtained only from the pockets of our children and grandchildren).

Cashflow from captive island ratepayers is essential because Muskrat Falls is UNECONOMIC as an out of province revenue generator, and UNECONOMIC in terms of sales to Labrador's mining giants (energy sales to both can only be at a huge loss --- in effect HIGHLY subsidized by island ratepayers).

ACCURATE, RELIABLE FORECASTING ? ---- You decide.

Nalcor claims therefore that the island’s forecast demand ensures the viability of Muskrat Falls.

But is it RATIONAL to incur BILLIONS of dollars in debt servicing and operating costs ($14.5 billion over 50 years) and to spend BILLIONS of windfall oil revenues based on Nalcor’s 10 year track record that repeatedly OVER-FORECAST the island’s total demand* at an average ERROR RATE of 110 megawatts (MW) per year** --- 8 times the industry standard of plus or minus 14 megawatts (+ or - 1%) annually?

Given Nalcor’s UNRELIABLE 10-year track record, how can Nalcor’s 50-year forecast be a RELIABLE basis on which to conclude that Muskrat Falls is VIABLE ?

Cashflow from captive island ratepayers is essential because Muskrat Falls is UNECONOMIC as an out of province revenue generator, and UNECONOMIC in terms of sales to Labrador's mining giants (energy sales to both can only be at a huge loss --- in effect HIGHLY subsidized by island ratepayers).

ACCURATE, RELIABLE FORECASTING ? ---- You decide.

Nalcor claims therefore that the island’s forecast demand ensures the viability of Muskrat Falls.

But is it RATIONAL to incur BILLIONS of dollars in debt servicing and operating costs ($14.5 billion over 50 years) and to spend BILLIONS of windfall oil revenues based on Nalcor’s 10 year track record that repeatedly OVER-FORECAST the island’s total demand* at an average ERROR RATE of 110 megawatts (MW) per year** --- 8 times the industry standard of plus or minus 14 megawatts (+ or - 1%) annually?

Given Nalcor’s UNRELIABLE 10-year track record, how can Nalcor’s 50-year forecast be a RELIABLE basis on which to conclude that Muskrat Falls is VIABLE ?

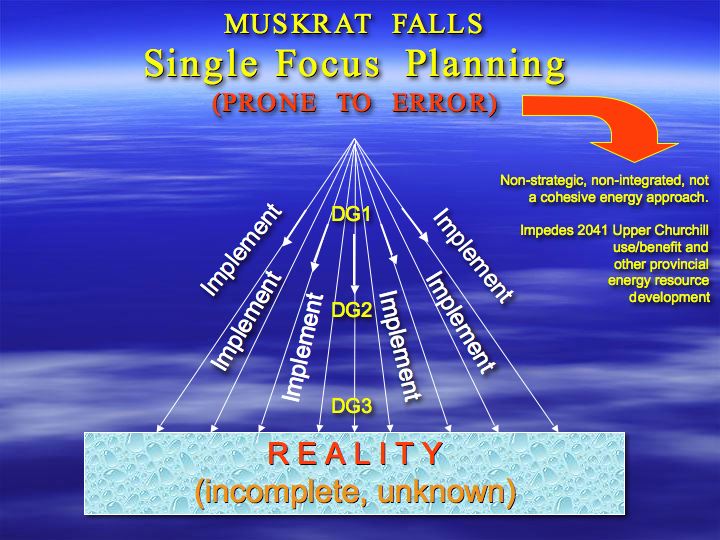

Nalcor claims that Muskrat Falls is viable based solely on the island's forecast demand.

But is Nalcor's forecast track record a

RELIABLE and RATIONAL

basis on which to sanction Muskrat Falls ?

(the only two 'independent' reviews concluded that Nalcor had NOT shown that the island needed the power)

--------------------------------------

Given that government is likely aware that the island's ACTUAL power needs could not rationally support a sanction decision for this high cost

Muskrat Falls project,

look for government to include NEW Decision Gate 3 (DG3) demand forecast numbers

to bolster its demand forecasts.

These new numbers will likely include potential power needs for the multi-billion dollar mining giant's of western Labrador

(including those associated with former premier Danny Williams)

Supplying Muskrat Falls power to these mining giants will substantially increase the cost of the project, and will cost island ratepayers about 10 times more

than any potential revenues received.

Muskrat Falls

will therefore mean cheap power

for the mining giants of western Labrador ---

at the price of a

50-year, locked in, high cost, high debt, high electricity rate

"take or pay" contract

for

ordinary, captive, island ratepayers.

In effect

Muskrat Falls will be built

so that

the potential power needs of the multi-billion dollar

mining giants of

western Labrador will be paid for by you,

by me, by our children and our grandchildren --- for at least

the next 50 years.

If island demand cannot be relied on ---- where will the revenue needed to pay down our INCREASED debt come from? HIGHER electricity rates? HIGHER taxes?

Muskrat Falls power sold to either the mining giants of Labrador or through outside sales to Emera --- can only be SOLD AT A SUBSTANTIAL LOSS.

As seen above, island electricity sales are far from assured. How then can it be said that Nalcor's forecast revenue from island ratepayers is a sound, rational basis on which to commit island ratepayers to a 50-year, multi-billion dollar, unneeded hydro project ?

Muskrat Falls power sold to either the mining giants of Labrador or through outside sales to Emera --- can only be SOLD AT A SUBSTANTIAL LOSS.

As seen above, island electricity sales are far from assured. How then can it be said that Nalcor's forecast revenue from island ratepayers is a sound, rational basis on which to commit island ratepayers to a 50-year, multi-billion dollar, unneeded hydro project ?

Please note also, that in year 2011 alone, Nalcor spilled the water equivalent of 694 GWh of energy from our already existing island hydro sites --- more than $100 million in value --- lost, --- wasted --- all while Nalcor claims that the island NEEDS MORE POWER.

Early on, Nalcor argued that Vale's, Long Harbour processing plant's energy needs would have to be met by doubling the demand (and therefore using more oil) at the Holyrood plant.

However, during the PUB review, (when questioned about the excess water spillage) Nalcor advised that they expected to continue spilling excess water until the Vale plant comes on stream to use the excess power capacity.

It is clear then, that Vale's energy needs can and will, in part, be met by EXISTING, EXCESS, ISLAND HYDRO capacity. While some increase in Holyrood use can be expected, Vale's needs will not therefore be met solely through Holyrood.

Nalcor's own statements show therefore that at times there is not even enough demand on the island to use up our EXISTING capacity.

So who is it --- really --- that wants Muskrat Falls power? And why?

And who will pay for it??

Early on, Nalcor argued that Vale's, Long Harbour processing plant's energy needs would have to be met by doubling the demand (and therefore using more oil) at the Holyrood plant.

However, during the PUB review, (when questioned about the excess water spillage) Nalcor advised that they expected to continue spilling excess water until the Vale plant comes on stream to use the excess power capacity.

It is clear then, that Vale's energy needs can and will, in part, be met by EXISTING, EXCESS, ISLAND HYDRO capacity. While some increase in Holyrood use can be expected, Vale's needs will not therefore be met solely through Holyrood.

Nalcor's own statements show therefore that at times there is not even enough demand on the island to use up our EXISTING capacity.

So who is it --- really --- that wants Muskrat Falls power? And why?

And who will pay for it??