Click to enlarge

Why is Muskrat Falls being built?

MUSKRAT FALLS

A PUBLIC SECTOR ONLY, 8.5 BILLION DOLLAR

CLIMATE CHANGE PROJECT

PAID FOR BY RATEPAYERS

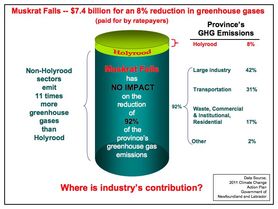

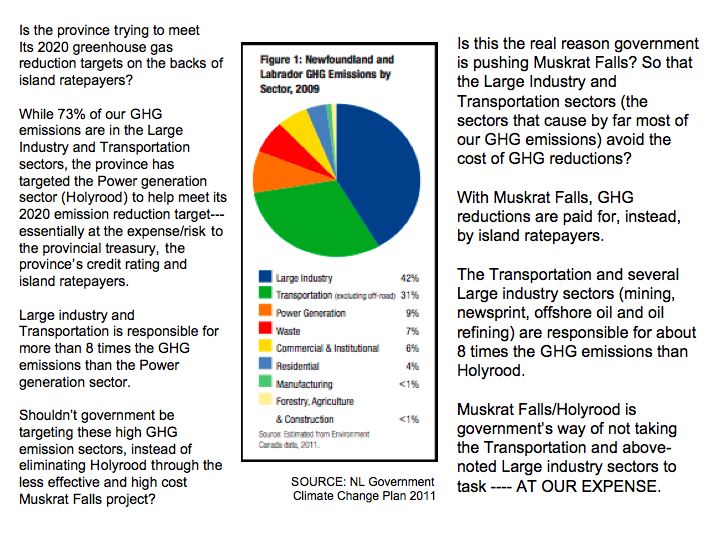

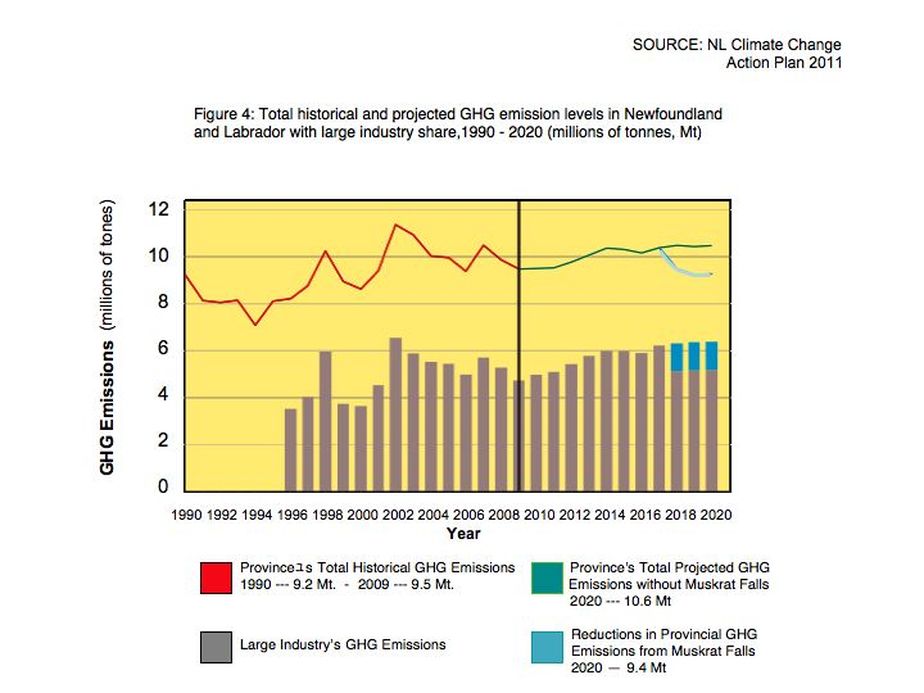

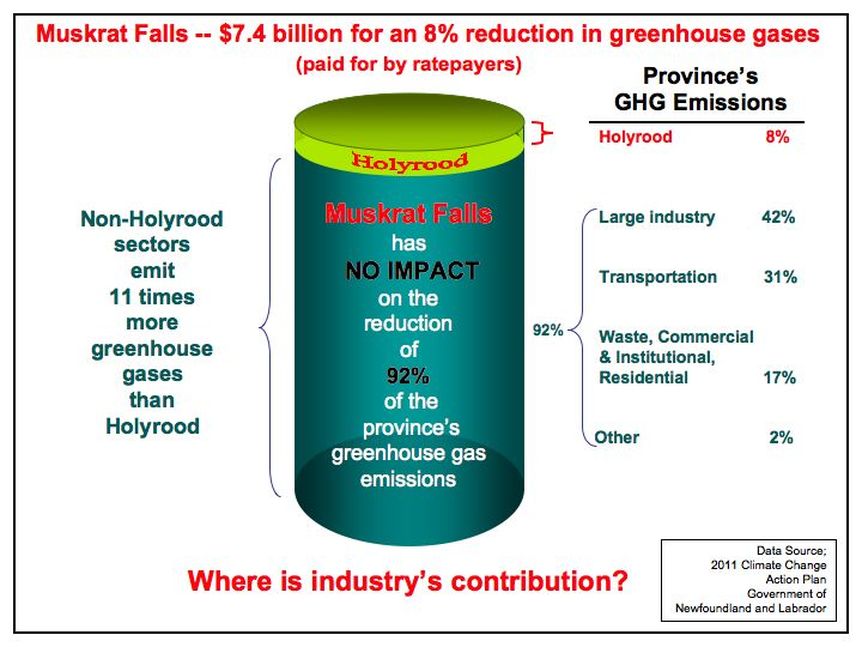

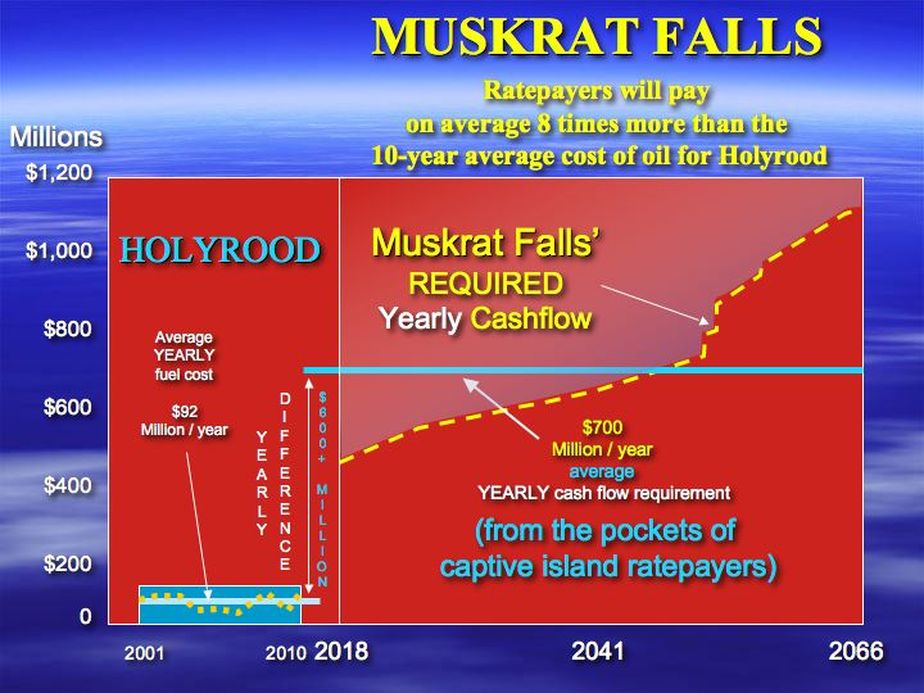

While the province's "Transportation" and "Large Industry" sectors are responsible for 73% of greenhouse gas (GHG) emissions, government's solution is to move towards its GHG reduction target by reducing emissions from its publicly owned, much smaller, 9% emitter --- the "Electricity Generation" sector (Nalcor) --- paid for, lock stock and barrel --- by island "RATEPAYERS" [$8.5 BILLION(?)].

Since the province's "Transportation" and "Large Industry" sectors account for 73% of GHG emissions (and only 8% for Holyrood), why is it that the bulk of the costs associated with the province's GHG reduction plan ($8.5 billion) will not be borne by the largest emitters, but instead by residential/island ratepayers?

Is then the push to build Muskrat Falls driven by government's plan to shelter large GHG emitters (the Transportation and Large Industry sectors) from developing effective GHG reduction plans and thereby allowing these large emitters to avoid taking responsibility and paying for their fair share of costs associated with GHG reductions?

Without real Transportation and Large Industry sector GHG reduction plans, sanctioning Muskrat Falls is at best a 'temporary' GHG solution and does not place the cost of the province's GHG reductions where it belongs --- at the feet of the largest emitters.

Instead, GHG reduction responsibilities are being laid almost totally at the feet of the "Electricity Generation" sector (Nalcor), a 9% greenhouse gas emitter whose $8.5 billion plan is to shut down Holyrood and which is at best, a "temporary" 8% GHG reduction solution --- paid for lock, stock and barrel --- by island "RATEPAYERS".

Some vision.... some project.... some plan.... some solution.

Whose "best interest" is government looking out for?

Newfoundland and Labrador Climate Change Action Plan 2011 - QUOTE:

5.3 Large Industry:

"In the 2007 Energy Plan, the Provincial Government committed to develop a GHG Strategy for the Energy-Intensive Sector, recognizing the level of GHG emissions they release in the province. This sector currently comprises five sub-sectors, namely, electricity generation, mining, newsprint, offshore oil, and oil refining, across which there are currently nine entities operating in the province: Newfoundland and Labrador Hydro’s thermal generating station at Holyrood, Iron Ore Company of Canada, Vale Inco, Wabush Mines, Corner Brook Pulp and Paper, the three offshore oil operations (Suncor,Husky and ExxonMobil), and North Atlantic Refining Limited.

In 2009, these companies were estimated to utilize 40 per cent of energy consumed in the province, and account for 50 per cent of provincial GHG emissions (42 per cent excluding the Holyrood thermal generating station). "

Objective 2.1

"Pursue the greenhouse gas (GHG) reduction targets of the Conference of New England Governors and Eastern Canadian Premiers on a provincial basis: 10 per cent below 1990 levels by 2020 and 75-85 per cent below 2001 levels by 2050.

Large Industry

• Pursue the development of the Muskrat Falls hydroelectric project and, through an interconnect with the island of Newfoundland, eliminate 1.2 Mt of GHG emissions from the Holyrood Generating Station". UNQUOTE

NOTE: Even though the "Electricity Generation" and "Residential" sectors produce only 9% and 4% respectively of the provinces GHG emissions (compared to 73% for the combined Transportation and Large industry sectors -- see graph below), Large industry's main contribution towards meeting the province's 2020 GHG reduction target is for Muskrat Falls to replace Holyrood (paid for, lock and stock and barrel by the 8% and 4% ---- island residents/ratepayers).

READ ON:

See Figure 1. (below) from

NL government's Climate Change Action Plan 2011

(Click Figure 1 to enlarge)

|

NOTE THAT: The "Residential" sector causes only 4% of the provinces GHG emissions. Why then are "residents" / "ratepayers" paying the shot?

Why are ratepayers/residents on the hook so that the Transportation and Large industry sectors can avoid their fair share of the cost of GHG reductions? http://www.exec.gov.nl.ca/exec/cceeet/2011_climate_change_action_plan.html ------------------------------------------------------------------------------------ TRANSPORTATION: 28 Sept. 2012 (National Post) "CN has retrofitted two of its existing diesel-fired locomotives to run mainly on natural gas. It’s testing the locomotives along the 480-kilometre stretch between Edmonton and Fort McMurray, Alta." -------------------------------------------------------------------------- "FedEx and UPS are both in the early stages of converting their fleets to run on NG (natural gas). By the end of the year, everyday consumers will be able to buy not just natural gas Honda Civics but Chevy, Ford, GMC, and RAM pickups running on NG as well. Enthusiasm is rising because of NG's attributes. It's significantly cheaper than gasoline on an energy-equivalent basis. It burns cleanly, spewing relatively little carbon into the atmosphere...At the current rate of consumption, there's enough NG in the U.S. to last 90 years; the more we explore our shale gas formations, the more we find." SOURCE: "Gas, Naturally, another step in mankind's ascent from carbon to hydrogen", Car and Driver, July, 2012. Why isn't government fostering the development of our own natural gas industry to reduce GHG emissions from our truly heavy emitters --- the Transportation and Large industry sector, as well as for use at Holyrood? |

NEWS

G & M, September 27, 2012

"The world’s biggest investors fear a fresh market crisis will erupt in the next 12 months amid worries that troubles in the eurozone will hit global growth and cause disruption in the financial system similar to the collapse of Lehman Brothers. More than 70 per cent of investors warn that a so-called tail-risk event, an external shock that causes a market sell-off and potentially threatens the financial system, will happen in the next year, says State Street Global Advisors. State Street, (is) the third biggest manager of money in the world…." http://www.theglobeandmail.com/globe-investor/investment-ideas/top-investors-expect-financial-tsunami-in-next-year-survey/article4569722/ ----------------------------------------------------------- "In June 2012, the Hamilton Project at the Brookings Institution in Washington, D.C., valued the current full cost of electricity generation from natural gas at four cents per kilowatt hour (kw/h). The fuel component is 1.4 cents." Source: The Telegram, 11 September 2012. http://www.thetelegram.com/Opinion/Letters-to-the-editor/2012-09-11/article-3072230/Weighing-the-facts-on-Muskrat-Falls/1 SEE ALSO: "On Aug. 29, Manitoba’s PUB authorized an interim, urgent rate increase of 2.5 per cent for the utility’s customers — that’s on top of a two per cent increase in April and a planned 3.5 per cent increase already under examination for next year. Why the latest urgently needed increase? Here’s the PUB order: “By any terminology, however, Manitoba Hydro’s (MH) current financial situation is of significant or major concern, is problematic and warrants intervention. … The increase is only granted to preserve the financial stability of the utility based on current available information and upon consideration of the submissions made.” Source: The Telegram, 11 September 2012. http://www.thetelegram.com/Opinion/Columns/2012-09-11/article-3072232/Bleeding-money/1 |

NEWS

G & M 28 September 2012

"In a speech to the Canadian Club of Toronto at the Royal

York Hotel, NDP Leader Thomas Mulcair gave his clearest sign of support yet for

the notion of a west-to-east pipeline that would allow western producers to

receive higher prices for their crude and refiners in Eastern Canada to replace

imported supplies of oil with North American product.

Refiners in Eastern Canada are currently paying world prices for their oil, which is trading at $12-per-barrel more than the trendsetting West Texas intermediate crude due to an over-supply of oil in the central U.S." Could that knock 10% off the so-called cost advantage of Muskrat Falls? Other highly recommended reading: 1. http://www.thetelegram.com/Blog-Article/b/22673/Muskrat-Media4 2. http://www.thetelegram.com/Blog-Article/b/22677/Muskrat-Media5 |

Government has clearly targeted the publicly owned emitter (Holyrood) at a cost of $7.4 billion for ratepayers/taxpayers, when 92% of the province's greenhouse gas emissions are from other sources unaffected by Muskrat Falls, and the private sector Large Industry (largest emitter) is all but ignored. An 8% GHG reduction on the backs of ratepayers (even though 'residential' only accounts for 4% of GHG emissions).

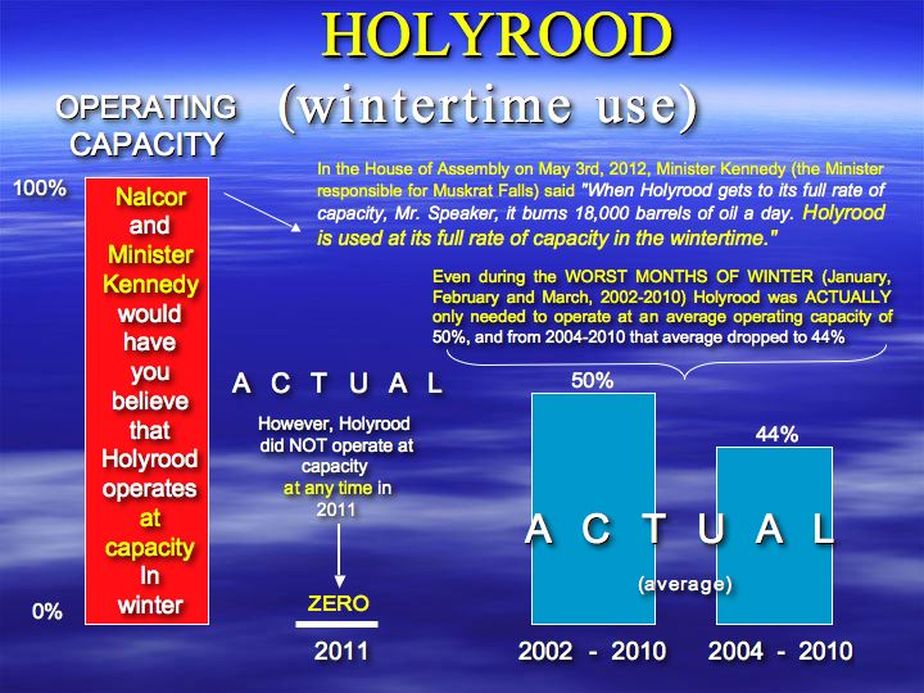

PLEASE NOTE, I also asked Nalcor (back in May, 2012) to advise whether Holyrood operated at any time at capacity over the last 10 years, but received no reply.

NEWS BULLETIN

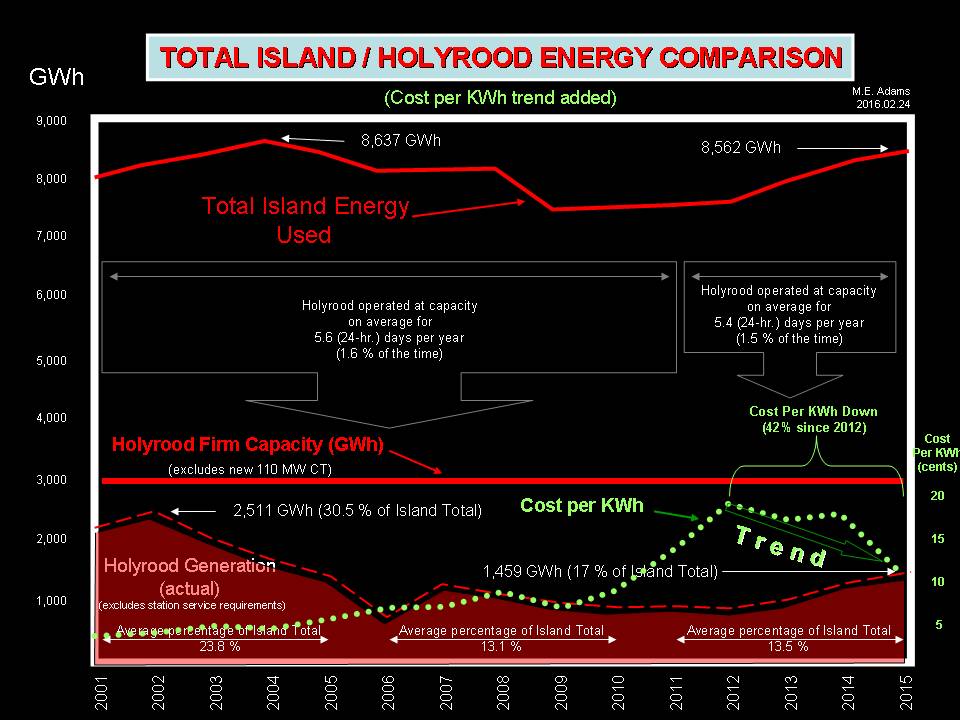

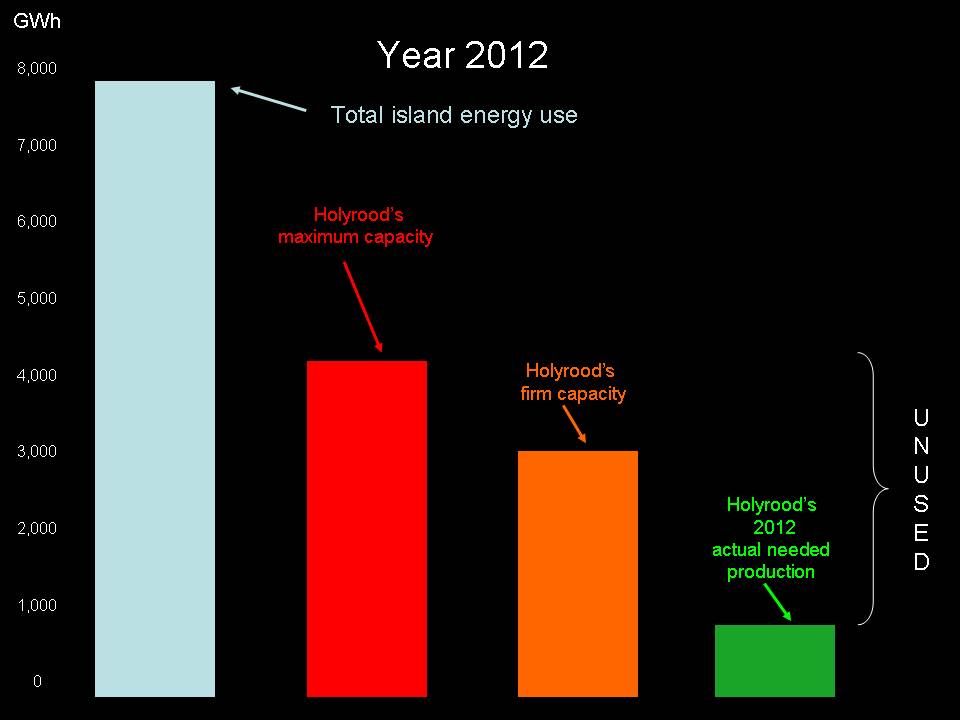

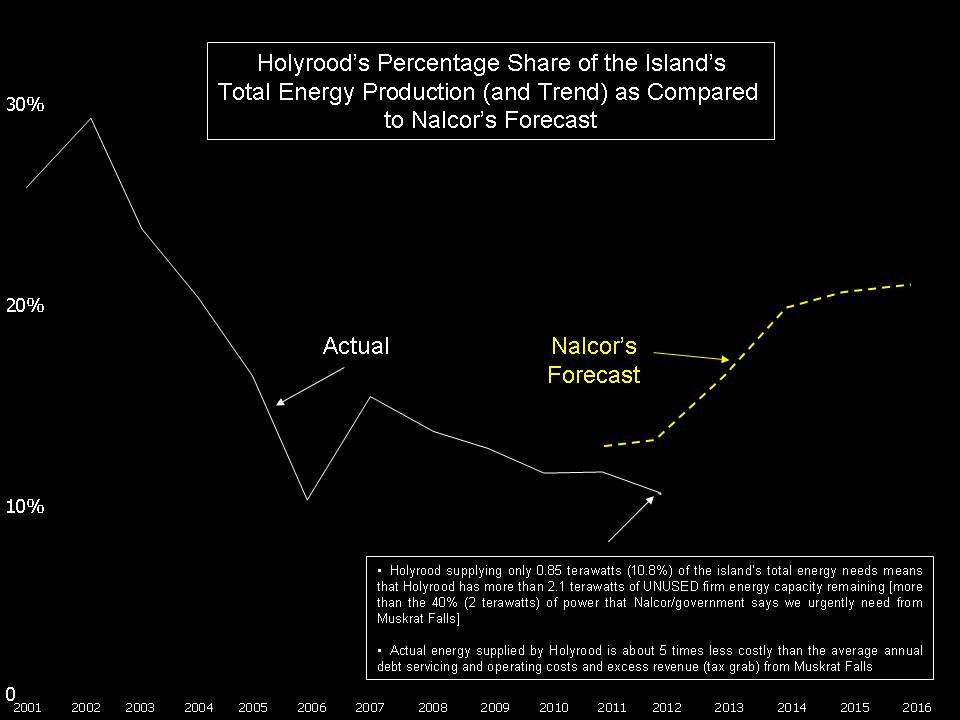

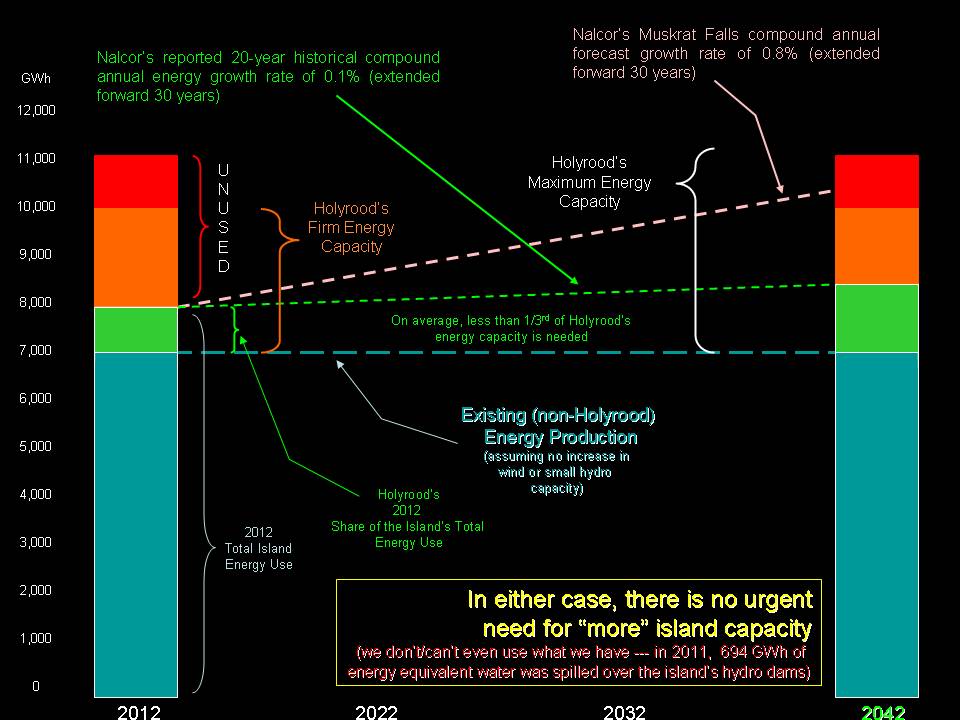

NALCOR advises (as of July 10, 2012) that OVER THE LAST NINE (9) YEARS, Holyrood has operated AT CAPACITY (which Nalcor defines as operating at greater than 95% capacity) LESS THAN 2% OF THE TIME (actually less than 1.6% of the time).

SEE QUOTE BELOW (from Nalcor's Leadership website):

"Mr. Adams, The Holyrood Plant has operated at or near capacity (e.g. >95%) in the nine-year period 2003-2011 for approximately 1,250 hours, or less than 2% of the time. It is rare for the Holyrood Plant to operate at full capacity because Hydro is committed to minimizing the use of oil-fired generation. We do this by using our hydroelectric and wind sources as much as possible to offset generation at the Holyrood Plant. The Holyrood Plant would operate at full capacity only if essential to meet the system load requirements, primarily under contingency situations (e.g. significant loss of generation or transmission capability).

The total Island actual energy demand for year 2011 (non-weather adjusted) was 7651.5 GWh. The estimated weather adjusted island energy demand for 2011 was 7742.5 GWh".

So, while Nalcor's Muskrat Falls vice-president, Gilbert Bennett; Minister Tom Marshall, and Minister Kennedy all like to say that Holyrood operates at capacity in the winter and burns 18,000 barrels of oil a day operating at capacity ---- the facts show that on average, Holyrood operates AT CAPACITY for LESS THAN SIX (6) days a year ---- and NOT AT ALL IN 2011.

So, while government gives the impression that Holyrood uses 18,000 barrels of oil A DAY in winter (at $100/barrel that would be $180 million over a 100 day winter), on average over the entire 100 day winter period, Holyrood would operate at capacity for less than 6 days and the oil cost while operating at capacity would be about $10 million (not $180 million). Of course, total oil costs over the entire winter is greater than $10 million, as Holyrood operates over much of the 100 day winter period ---- BUT NOT AT (or near) CAPACITY.

NEWS BULLETIN

NALCOR advises (as of July 10, 2012) that OVER THE LAST NINE (9) YEARS, Holyrood has operated AT CAPACITY (which Nalcor defines as operating at greater than 95% capacity) LESS THAN 2% OF THE TIME (actually less than 1.6% of the time).

SEE QUOTE BELOW (from Nalcor's Leadership website):

"Mr. Adams, The Holyrood Plant has operated at or near capacity (e.g. >95%) in the nine-year period 2003-2011 for approximately 1,250 hours, or less than 2% of the time. It is rare for the Holyrood Plant to operate at full capacity because Hydro is committed to minimizing the use of oil-fired generation. We do this by using our hydroelectric and wind sources as much as possible to offset generation at the Holyrood Plant. The Holyrood Plant would operate at full capacity only if essential to meet the system load requirements, primarily under contingency situations (e.g. significant loss of generation or transmission capability).

The total Island actual energy demand for year 2011 (non-weather adjusted) was 7651.5 GWh. The estimated weather adjusted island energy demand for 2011 was 7742.5 GWh".

So, while Nalcor's Muskrat Falls vice-president, Gilbert Bennett; Minister Tom Marshall, and Minister Kennedy all like to say that Holyrood operates at capacity in the winter and burns 18,000 barrels of oil a day operating at capacity ---- the facts show that on average, Holyrood operates AT CAPACITY for LESS THAN SIX (6) days a year ---- and NOT AT ALL IN 2011.

So, while government gives the impression that Holyrood uses 18,000 barrels of oil A DAY in winter (at $100/barrel that would be $180 million over a 100 day winter), on average over the entire 100 day winter period, Holyrood would operate at capacity for less than 6 days and the oil cost while operating at capacity would be about $10 million (not $180 million). Of course, total oil costs over the entire winter is greater than $10 million, as Holyrood operates over much of the 100 day winter period ---- BUT NOT AT (or near) CAPACITY.